Will Inflation Put Us Into a Depression?

In July of 2022, the United States Bureau of Labor Statistics reported an annual inflation rate of 8.5%, a print not seen in multiple decades. This is a problem. A big one. But, could it lead the United States economy into a depression?

In this article, I am going to explore the relationship between historically high inflation rates and the potential for an economic depression. In doing so, I’ll start by defining some key terms, provide a brief overview of why inflation is so problematic, describe what is done to fight it, and how it could potentially lead us into a depression. By the end, you’ll have a better understanding of the current macroeconomic environment and how it can impact the multifamily investment landscape.

I’m Rod Khleif. I am an entrepreneur, real estate investor, multiple business owner, author, mentor, and community philanthropist who is passionate about business, life, success, and giving back. As one of the country’s top real estate trainers, I have personally owned and managed over 2,000 properties and authored the book “How to Create Lifetime Cash Flow Through Multifamily Properties,” which is considered to be an essential “textbook” for aspiring multifamily investors.

Key Definitions

To answer the question, will inflation put us into a depression, it is first necessary to begin by defining the two key terms in this article, inflation and depression.

What is Inflation?

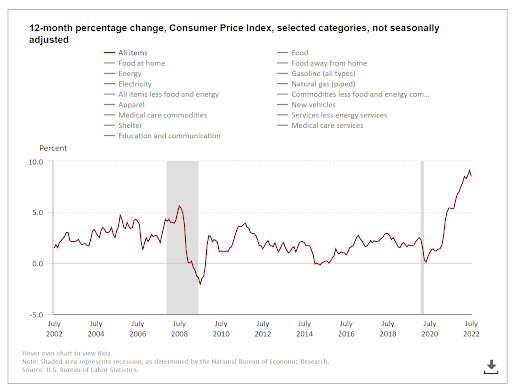

While we are probably all familiar with the concept, the official definition of inflation, according to the Federal Reserve, is the increase in the price of goods and services over time. It is typically measured using the “Consumer Price Index,” which measures the change in price for a basket of goods and services.

Generally, inflation happens when there is too much demand for not enough goods and services. For example, if a growing market does not have enough housing, competition for existing housing will drive prices up.

One of the main jobs of the Federal Reserve is to try and manage inflation to a target rate of ~2% annually. With this context, it can be seen that the July report of 8.5% is more than four times the target rate. This is why it is a problem.

What is a Depression?

An economic depression is a period of a sustained downturn in economic activity. It is the more severe form of a recession, which is measured as two consecutive quarters of negative GDP growth. Typically, the severity of a depression or recession is characterized by large increases in the unemployment rate, large decreases in the availability of credit, corporate bankruptcies, stock market crashes, and even price deflation.

In the United States, the Great Depression of the 1930s is the most recent major depression, which saw a 33% decrease in GDP and an unemployment rate of ~25%. It was preceded by a major stock market crash in 1929.

The most recent recession followed the housing market crash in 2008/2009, which was also preceded by a stock market crash.

Depressions and recessions are the opposite of an inflationary environment. They are caused by the near collapse in demand for goods and services, which can cause a deflationary environment – also a bad thing.

So, with these two definitions in mind, let’s explore the relationship between an inflationary environment and a depression/recession.

How Did We Get Here?

The origins of the 2022 inflationary environment can be traced to the beginning of the COVID 19 pandemic in March of 2020. Remember that time? A new, highly contagious virus was detected in the United States and the general guidance from health authorities was to avoid crowded places like bars, restaurants, and airports. In fact, they went so far as to “lock down” many places and recommend that we stay home and don’t go anywhere. For the most part, the advice was followed.

Lockdowns caused a sudden and swift collapse in economic activity. Seemingly overnight restaurants and stores closed, airlines cut back, and events were canceled – resulting in the loss of nearly ~23 million jobs in just 3 months. This sudden and dramatic loss of jobs made for an equally sudden and dramatic collapse in economic activity, as measured by a GDP decrease of 9.5% in the 2nd quarter of 2020. This is enormous – the largest decrease since the 1950s.

The government’s response to the pandemic was also stunning. The most significant actions they took include:

- Cutting interest rates to near 0% between two meetings in March of 2020. In addition, they provided guidance that rates would stay near zero until they were confident the economy was fully recovered.

- Implemented a “Quantitative Easing” program what purchased $80B of bonds a month

- Created or activated a number of direct lending programs, like the Paycheck Protection Program, that injected hundreds of billions of dollars into the economy.

All told, through their various programs and loans, the government injected $5 trillion of stimulus into the economy during the early stages of the pandemic – an amount with no historical precedent.

When this astonishing amount of stimulus was combined with COVID related factory shutdowns and a shortage of goods, it created a near perfect storm for inflation to accelerate. From the chart below, it can be seen that inflation was flat going into the pandemic and went nearly vertical at around the same time the COVID-related economic stimulus programs kicked in.

So to summarize, our current inflationary environment was triggered by far too much money chasing scarce goods and services – causing prices to accelerate.

OK, But Now What?

Interest rates are the government’s primary weapon in the fight against inflation and they have not held back. Since March of 2022, the Federal Reserve has raised interest rates by 2% and more increases are expected – the fastest pace of rate hikes since 2000.

The hope is that increasing interest rates will make borrowing more expensive – which will slow down borrowing and investment activity. As these activities slow down, so does demand for goods and services, which will hopefully slow inflation. The early signs are that the rate increases are working as of July 2022.

But, It is a Slippery Slope

While rate increases are necessary to tame inflation, they are a slippery slope. If the Federal Reserve raises them too far, too fast, they risk a total collapse in demand – which could lead to a recession or depression. However, in an ideal scenario – a so-called “soft landing” – gradual rate increases cause a gradual decline in demand which brings inflation back to more normalized levels.

So, Are We Headed For a Depression?

It is extremely difficult to predict a depression, but my sense is that we are probably not headed for a full scale depression. However, a recession – the less severe form of a depression – is certainly a possibility that investors must prepare for. Let’s review both sides of the case.

Why We Could Be Headed For a Recession

The case for a recession can be made in five points: (1) sector level inflation; (2) layoffs; (3) continued rate hikes; (4) economist predictions; and (5) GDP.

Inflation

While an annual inflation figure of 8.5% is very high by historical standards, increases are not felt evenly across all sectors. Gas is up 44%, airfare nearly 28%, electricity rates 15.2%, and food 13%. Further, rents in certain cities like Miami, Orlando, or Austin have jumped more than 20% since 2019.

These sorts of price increases are unsustainable and could very easily put a significant dent in demand. Instead of driving, people could carpool. Instead of renting a new place, they may stay put in their current one or move in with family. Instead of moving to high profile cities like Miami, Orlando, or Austin, they may choose more affordable cities like Pittsburgh or Des Moines.

Layoffs

As these declines in demand begin to take hold, the ramifications can become real. Recently, Amazon announced job cuts of 100,000 workers, Google has prepared workers for a large round of layoffs, Netflix has cut jobs, Facebook is threatening significant cuts of up to 10% of the total workforce, and the website Layoffs.fyi is tracking ~71,000 layoffs among 520 startups including notable names like Peleton, Sweetgreen, and Daily Harvest.

Non-tech companies announcing layoffs include industry stalwarts like Ford, JP Morgan, Wells Fargo, and CVS. Traditionally, job losses are a sign of bad things on the horizon and, if things get worse, they could accelerate.

Continued Rate Hikes

The Federal Reserve has already increased interest rates from near zero to ~2.50% and they aren’t done. The general expectation is that they will continue to hike rates until they get to somewhere between 3.50% and 4%. These continued rate hikes are likely to further soften demand and increase the odds for a recession.

The Experts

According to this article from the Washington Post, quoting Bloomberg Economics, the belief is that there is a 75% chance that we are headed for a recession by the start of 2024. In addition, economists at Deutsche Bank and Wells Fargo predict a recession by mid-2023 and those at Nomura Holdings expect one even sooner in mid-2022.

In short, the experts think a recession is coming, even if there is some disagreement about how severe it will be.

GDP

Remember, the official definition of a recession is two consecutive quarters of negative GDP growth. By this measure, we are already in a recession. In Q12022, GDP contracted 1.6% and in Q22022, it contracted .9%. But, it should be noted that there is strong disagreement about whether this is a true economic contraction or a byproduct of the supply chain issues that have hampered companies nationwide.

So, there is a convincing case that we are already in or headed for a recession. The data support this point, but there are two equally strong points that muddy the picture.

Why We Aren’t Headed For a Recession

While the evidence for a recession is compelling, there are two data points that point strongly in the other direction.

Jobs, Jobs, Jobs

Yes, I mentioned many planned layoffs in the previous section. However, there is an argument to be made that these are more the result of a desire for efficiency than an indicator of a weakening economy.

Recently, the July jobs report delivered a shocker by adding 528,000 jobs, more than double economist expectations. More importantly, this addition of jobs marks a recovery of all jobs lost during the pandemic and a drop in the unemployment rate to 3.5%, matching a half century low.

A job market this strong is not typically associated with a recession or depression. Of course, it could change quickly, but right now it is remarkably strong.

Housing Shortage

Depending on how it is measured, housing contributes somewhere between 15% and 18% to GDP, one of the largest sectors. In the last recession, it was housing that led us in and prices went through a major correction. This is not the case in 2022. Freddie Mac estimates that there is a housing shortage of 3.8M units. In addition, housing inventory at the time of writing is 9.2 months, which is a historically healthy number.

So, if there is going to be a recession, it is unlikely that it is going to be housing that leads us in.

So, the continued strength of the housing sector combined with a very robust job market supports the idea that there will be more of a “soft landing” than an outright recession.

How Does This Impact Multifamily Housing?

Given the arguments on both sides of the recession debate, it is tough to say exactly what is going to happen. But, given the uncertainty, I think it is best to prepare like we are headed into a recession. So, here are a few tips to do so:

- Don’t Stretch: On the acquisition side, it is time to tighten the underwriting criteria, particularly as it relates to assumptions about rent growth, cap rates, vacancy, and interest rates on debt. Don’t stretch to pay a price that assumes strong growth going forward. We don’t know if this will be the case.

- Raise Cash: The saying “cash is king” is never more true than during an economic downturn. So, now is a great time to raise cash. This can be done by a variety of methods like trimming operating expenses, renegotiating service contracts, and even considering a capital call from investors. This cash can be essential for seeing the property through a recessionary period.

- Evaluate Reserves: Times of economic distress can stress reserves. For example, there may be additional costs associated with collecting late rent or legal fees that go along with evictions. Robust operational reserves are critical to provide some cushion for the unexpected. Look at your operational reserve amounts to see if they are enough to get through a severe downturn. If they aren’t, replenish them with some of the cash raised.

- Review Your Maintenance Plan: Of course a robust maintenance plan is critical to the successful operation of a property. But, a pending recession may be time to review it to see if there are items that can be deferred in an effort to cut costs.

- Review Your Loan Terms: Interest rates are more likely to go higher before they go lower. Review your debt to determine if there is a possibility that it could be refinanced or re-structured to a more favorable rate or a longer term.

- Review Your Rental Rates: A full property is a perfect antidote to a recession. Review your rental rates and occupancy levels to see if there are any incentives that can be offered to fill up the property.

- Adjust Your Expectations: Finally, it may be necessary to adjust your return expectations – at least in the short term. But, remember that economic activity runs in cycles. A short term decline is likely to be followed by a period of rate cutting and demand stimulation. This is a long term tailwind.

So, are we headed for a depression? Probably not. But, I think we are likely headed for a recession – if we aren’t already in one – and it is necessary for all multifamily investors to be prepared.