|

As part of our ongoing series of sub-market analysis, today we will discuss Athens, Georgia. This is an area that we have been actively scouting for investment opportunities over the past few years. What we look for in a sub-market: |

|

|

Athens Statistics: Athens is a growing city of predominantly upwardly mobile, educated individuals. In fact, 11% of the population is employed in computer and math fields, which places it in the 95th percentile of all US cities. 48% of the residents have at least a bachelor’s degree versus only 22% for the US average per city. The population today is 130k and growing consistently. Median income has grown from $43.5k in 2021 to $50.5k in 2023. The University of Georgia is located in the city center and has a huge impact on the job and housing market. The university draws in wealthy students from across the country, and developers have been building luxury student housing while affordable housing has been ignored. The university will continue to grow jobs, pushing income and rental demand higher. The median single family home costs $400k, which means with mortgage payments, taxes and insurance, the monthly payment would be around $3,442. To afford this home, the family income would have to be $132K per year. The average rent in the city is $1,680, which would require an income of $67K to not be rent burdened. From these numbers, it is clear that many in Athens lack affordable housing, and buying a house is out of the question for most. But it also points to very strong apartment demand for class C and B apartments. |

|

|

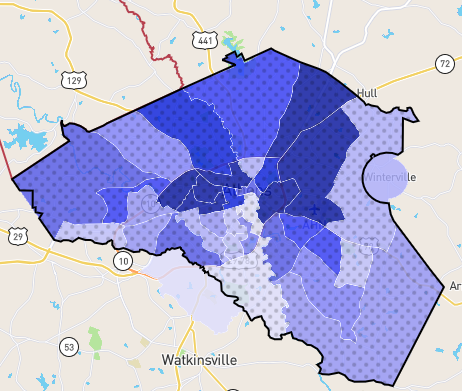

Athens is a very diverse city where location, location, location really matters. As you can see from the above crime chart, the safest and most desirable areas are in the southern half of the map. And as you would expect, the income levels also gravitate to the safer neighborhoods. We are focused on finding deals in the higher-income, lower-crime neighborhoods. Athens checks most of our boxes for an attractive sub-market for investment. It is critical to invest in an area that will not be battling against you as you try to implement your plan. It’s like planting the perfect tomato plant in rocky soil with no water: certain disaster! Now the hard part is to find a property that meets our strict requirements for IRR and cash-on-cash returns utilizing conservative assumptions. If we find an investment in Athens, we will be comfortable knowing the area will nurture our investment. |