The Fast‑Track Guide for First‑Time Multifamily Investors

Calculating returns shouldn’t feel like brain surgery. When I bought my very first property in 1981, I used a handheld calculator, a yellow pad, and a whole lot of guesswork. Today you have better tools and this guide on how to calculate cash on cash return. I’ll walk you through the math, the mindset, and the rookie mistakes to avoid so you can invest with confidence.

TLDR;

Cash‑on‑cash return equals annual pre‑tax cash flow divided by total cash invested. Start with net rental income, subtract operating costs and debt service, then divide that figure by your down payment, closing costs, and capital reserves. The result, expressed as a percentage, shows your yearly cash yield on money actually deployed.

What is Cash on Cash Return?

Cash on cash return (CoC) is an easy way to measure the yearly cash income you earn from your investment. This applies to a property or any asset that makes money. It is calculated before taxes. It shows how quickly you are “recovering” your initial investment through net operating income.

Why Does Cash on Cash Still Matter in 2025

Cash-on‑cash (CoC) tells you how hard your dollars work every single year with no fancy projections or crystal ball. In an environment where rates, rents, and regulations shift fast, cash on cash return is the clearest check on a deal’s viability.

New investors chase flashy “IRR” charts. But cash on cash tells you whether the property feeds you every month. Rising interest rates and tighter lending mean bigger mortgage payments in 2025. Your deal must spit out spendable cash, not just paper profits. HUD’s latest Multifamily Outlook confirms operating expenses rose 5.8 % last year (HUD, 2025). You need a cushion.

How Do You Calculate Cash on Cash Return?

The Cash-On-Cash Return equation is refreshingly simple, which means any error is painfully obvious. Master this math once and you’ll evaluate deals on napkins, flights, or wherever opportunity strikes.

Cash‑on‑Cash Return = (Annual Pre‑Tax Cash Flow ÷ Total Cash Invested) × 100

Annual Pre‑Tax Cash Flow = Net Operating Income (NOI) – Annual Debt Service

Total Cash Invested = Down Payment + Closing Costs + Initial Repairs/Reserves

A Real‑World Example

Theory is great; proof is better. Here’s a live‑ammo scenario that mirrors what beginners see in today’s marketplace. Follow along and you’ll spot the decision points that separate solid deals from money pits.

How to Calculate Cash on Cash Return Step-by-step

-

Find NOI. Rents $120,000; expenses $45,000 → NOI = $75,000.

-

Subtract Debt. Annual mortgage payments $48,000. Cash flow = $27,000.

-

Add Total Cash In. $250k + $25k + $25k = $300,000.

-

Divide and Multiply. $27,000 ÷ $300,000 = 0.09 → 9 % cash‑on‑cash return.

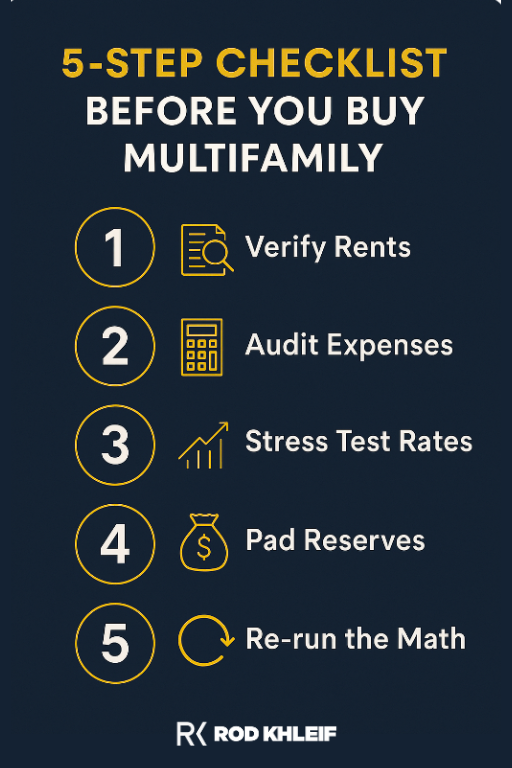

5 Step Checklist Before You Buy

Great returns start long before closing day. Run this checklist every time and you’ll sleep better, your investors will breathe easier, and your lender will view you as a pro.

-

Verify Rents. Call competing properties; demand trailing‑12 statements.

-

Audit Expenses. Insurance, taxes, and repairs creep up fast.

-

Stress‑Test Rates. Model a 1‑point interest bump on your loan.

-

Pad Reserves. Set aside at least $300 per unit, per year.

-

Re‑run the Math. If cash on cash drops below 6 %, renegotiate or walk.

Common Rookie Mistakes

Experience is a brutal teacher and she gives the test before the lesson. Skip the scars by learning where beginners usually stumble.

-

Counting appreciation as cash. Appreciation is gravy, not dinner.

-

Ignoring capital expenditures. Roofs leak when spreadsheets don’t.

-

Underestimating vacancy. Budget at least 5 % even in hot markets.

-

Using fake pro‑formas. Trust real rent rolls, not broker daydreams.

-

Forgetting taxes. Consult a CPA who understands real estate.

Advanced Move: Boosting Your Return

Once you master the basics, it’s time to boost your return from each property. These tactics turn a good deal into a home‑run without taking reckless risks.

-

Raise below‑market rents after light value‑adds. ex. paint, LED lights, smart locks.

-

Refinance once NOI jumps. Pull equity, lower payment, or both.

-

Master rubs (ratio utility billing) to pass water and trash to tenants.

Freddie Mac shows utility bill‑back programs can lift NOI 3–5 % (Freddie Mac Multifamily, 2024). That alone can push cash‑on‑cash from good to great.

Quick Comparison Table

Wondering how CoC stacks up against the cap rate you keep hearing about? Use this snapshot to keep each metric in its lane.

Internal Resources to Dig Deeper

Knowledge compounds faster than money. Dive into these tools and episodes to sharpen your edge between deals.

-

Crunch numbers with my Cap Rate Calculator

-

Learn exactly how to spot value in my Multifamily Syndication Guide

-

Hear investor success stories on the Lifetime Cash Flow Podcast

Key Takeaways

If you remember nothing else, tattoo these points on your investing brain.

Cash‑on‑Cash Is King. It measures real money in your pocket. You need to know how to calculate cash on cash return if you’re going t be investing in multifamily.

Use Real Numbers. Verify income, expenses, and debt terms.

Aim for 8 % or Higher. Anything less deserves a crystal‑clear upside plan.

Protect Liquidity. Keep reserves so surprises don’t kill returns.

Iterate Fast. Recalculate after every change. Include everything like rent bumps, refinance, rehab.

FAQs

Still scratching your head? These quick answers clear the fog so you can act now.

Does cash‑on‑cash include tax benefits?

No. It’s pre‑tax. Depreciation and cost segregation can sweeten returns later.

What’s a “good” cash‑on‑cash return in 2025?

For stabilized Class B/C assets, 8–12 % is competitive. Trophy assets may run lower.

How often should I recompute cash on cash return?

Run numbers at acquisition, quarterly during rehab, and annually thereafter.

Can I hit double‑digit returns in high‑cost markets?

Yes, but usually through heavy value add or partner capital. Stick to proven frameworks.

Ready to Accelerate?

Subscribe to the Lifetime Cash Flow Podcast for weekly deep dives.

Seats are filling fast for my next Multifamily Bootcamp. Claim yours now → www.rodkhleif.com/bootcamp.

Let’s build lifetime cash flow together!

-Rod Khleif