Houston Multifamily Foreclosures: A Growing Concern in a Strong Market

Houston has been making commercial real estate headlines, but not for the reasons you might expect. Despite being one of the strongest economic markets in the country, multifamily foreclosures in Houston are on the rise. This trend is surprising given the city’s booming job market, stable construction pipeline, and steady rent growth.

Houston is currently the second-highest city for job creation in the U.S., and it remains the only major Texas market where new construction aligns with long-term demand trends. Rental growth sits at 1.3% annually, and vacancy rates are a manageable 7.1%. Yet, a dozen marquee multifamily properties have slipped into foreclosure.

So what’s causing this spike in distressed assets? Let’s break down the key factors driving multifamily foreclosures in Houston and what investors should be watching.

Rising Interest Rates and Debt Pressures

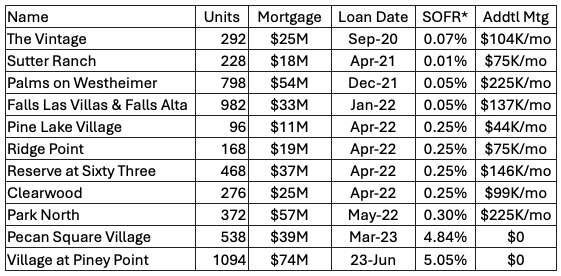

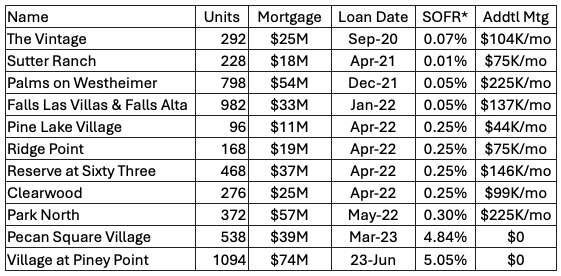

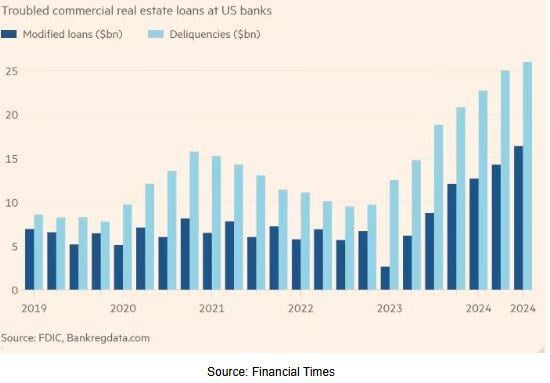

The recent wave of multifamily foreclosure filings in Houston shares a common thread: rising interest rates. Many of these properties were financed during the low-interest-rate environment of 2020-2021, when SOFR (Secured Overnight Financing Rate) was near 0%.

As SOFR climbed to 5.3% in July 2023, the cost of debt for properties with floating-rate mortgages (SOFR + spread)skyrocketed. While we don’t have the exact loan terms for each foreclosed property, it’s clear that some, if not most, were variable-rate loans.

For owners who failed to secure interest rate caps or refinance, the impact has been devastating. Higher monthly debt payments, coupled with rising insurance premiums, increasing operating costs, and maintenance expenses, have created a perfect storm of financial distress.

Crime and Property Management Issues

While interest rate spikes explain many of Houston’s multifamily foreclosures, there’s another factor at play—poor property management and crime-related tenant turnover.

Two recently foreclosed properties, The Village at Piney Point and Pecan Square, tell a different story. These assets were acquired more recently, meaning their financing costs haven’t changed significantly. Instead, tenant reviews paint a grim picture of deteriorating conditions:

- High crime rates

- Poor maintenance

- Unresponsive and rude property management

When tenant satisfaction drops, lease renewals decline and attracting new residents becomes difficult. This leads to higher vacancies, reduced rental income, and ultimately, financial distress. A bad reputation online can trigger a financial death spiral, making it nearly impossible for an owner to recover.

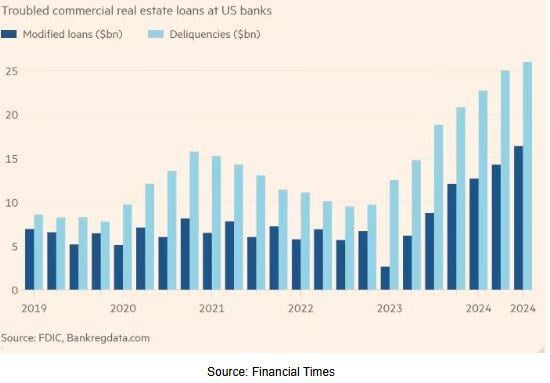

Lenders & The “Extend and Pretend” Strategy

Despite the spike in foreclosure filings, many of these properties may not actually reach foreclosure. Banks and lenders use foreclosure filings as leverage to pressure owners into negotiations.

Most lenders don’t want to take ownership of these properties—doing so forces them to recognize loan losses, which could destabilize their financials. Instead, many are pursuing a strategy known as “extend and pretend”, where they delay formal foreclosure and work behind the scenes to find well capitalized buyers willing to step in.

However, this approach isn’t sustainable. As more distressed multifamily loans pile up, banks will be forced to offload these assets, often at a loss. For opportunistic investors, this presents a unique buying opportunity.

Opportunities for Distressed Asset Investors

For savvy investors, the Houston multifamily foreclosure wave could create prime opportunities to acquire properties at deep discounts. However, not all distressed assets are worth pursuing. Here’s what to consider before making an offer:

✔ Understand the Cause of Distress – If high-interest rates are the issue, refinancing or restructuring the debt may solve the problem. However, if the property has serious management issues or crime problems, recovery could take years.

✔ Make Conservative Offers – Houston’s market is strong, but distressed properties often require significant capital investment. Factor in operating reserves, deferred maintenance, and rebranding costs before committing.

✔ Read Tenant Reviews – Online reviews can reveal operational issues, security concerns, or maintenance failuresthat could impact long-term profitability.

✔ Secure Rescue Capital – Investors with strong capital reserves or access to rescue capital will have a major advantage in acquiring and turning around struggling assets.

The Bottom Line

Houston’s multifamily market is still fundamentally strong, but rising interest rates, poor management, and lender pressure are driving an increasing number of properties into distress.

For well-prepared investors, this presents a rare opportunity to buy distressed multifamily properties at steep discounts. However, it’s critical to conduct thorough due diligence to ensure the underlying problems are fixable and that the timeline for recovery aligns with your investment strategy.

With the right approach, investors who navigate this market wisely can turn today’s distressed assets into tomorrow’s high-performing multifamily investments.

Rod Khleif’s Final Thoughts on Houston’s Multifamily Market

Listen, I’ve been in this business for decades, and if there’s one thing I’ve learned, it’s that real estate is cyclical. Markets rise and fall, and the smartest investors know how to capitalize on both sides of the cycle.

Right now, what’s happening in Houston’s multifamily market is not a sign of market weakness—it’s a sign of opportunity. Interest rate hikes, poor management, and lender pressure are exposing properties that weren’t well-positioned to weather the storm. That means savvy investors who understand value and have the right capital reserves can step in and take advantage of this moment.

But here’s the thing—not all distressed assets are good deals. Too many investors get emotional about “buying cheap” instead of focusing on buying smart. If you’re looking at foreclosed multifamily properties, you need to ask yourself the right questions:

- Is the issue fixable? If the only problem is financing, a new loan structure or capital injection could solve it. If the issue is crime, tenant turnover, or management failure, fixing it will take time, effort, and cash reserves.

- Does this deal fit your strategy? I always say, “You don’t get rich on your first deal, you get rich on your last deal.” Focus on long-term gains, not just a quick discount.

- Do you have the right team in place? If you buy a distressed asset, you’re signing up for a turnaround project. Make sure you have property managers, leasing teams, and renovation crews ready to execute.

I truly believe that Houston will remain a strong multifamily market, and the investors who act strategically now will be incredibly well-positioned when the market stabilizes.

So here’s my advice: Do your homework, stay conservative, and take action when the right opportunity comes along. Because in real estate, fortunes aren’t made when the market is hot—they’re made when others are too scared to step in.

🎧 Want to Learn from the Best in Multifamily Investing?

Join Rod Khleif, one of the top real estate investing coaches, as he interviews industry giants, breaks down powerful strategies, and shares the mindset secrets of top real estate investors.

👉 Listen Now: Lifetime Cash Flow Through Real Estate Investing Podcast