The Essential Principles of Successful Investing: Diversification and Timing

As we approach the end of the year, it’s crucial to reflect on the fundamental principles that guide successful investing. Today, I want to dive into two key concepts: diversification and the timeless strategy of “buy low, sell high.” These principles are not just buzzwords; they are essential tools in your investment arsenal.

Understanding Diversification

Diversification is your safety net in the unpredictable world of investing. When the next market downturn hits—and trust me, it will—having a diversified portfolio can mean the difference between weathering the storm and watching your investments plummet. Here’s why diversification matters:

- Risk Mitigation: If all your investments are tied to equities, your portfolio will likely drop in tandem with the market. This correlation can be detrimental during downturns.

- Asset Correlation: Stocks and bonds often behave differently under various market conditions. For instance, private multifamily investments have a low correlation to stocks (0.14), while REITs are more correlated (0.68). This means that when stocks falter, multifamily properties may hold their value better.

- Downside Protection: You don’t need a portfolio of assets that are 100% uncorrelated, but having a mix can provide a cushion when things go sideways.

The Current Market Landscape

Let’s take a moment to look at the current market conditions. In 2024, we’ve seen the S&P 500 soar by 25%, marking one of the best two-year stretches since the late 1990s. Corporate bond indexes have yielded around 5%, which, while decent, isn’t groundbreaking.

This surge in equity markets means many investors may now have a higher percentage of equity exposure than they did at the beginning of the year. But remember what Sir Isaac Newton wisely stated: “What goes up must come down.”

Historical Context

Historically, when stock valuations approach all-time highs, a market correction is often on the horizon. Consider these pivotal moments:

- The Great Depression (1930): A peak followed by a significant downturn.

- The Dot-Com Bubble (2000): Rapid growth led to a painful collapse.

- The Financial Crisis (2007-2009): A stark reminder of the risks of overexposure.

Experiencing a 50% drop in your portfolio can be devastating, as it requires a 100% gain just to return to your original investment level. This is why savvy investors avoid putting all their eggs in one basket.

The Bubble Effect: Beyond Equities

It’s not just equities that are showing signs of bubble-like pricing. Bitcoin has recently surpassed $100,000, despite having no intrinsic value, and gold has risen 31% this year, reaching $2,700 an ounce.

Using the principle of buy low, sell high, it may be time to consider taking some profits off the table and reallocating to investments that have underperformed.

The Multifamily Investment Opportunity

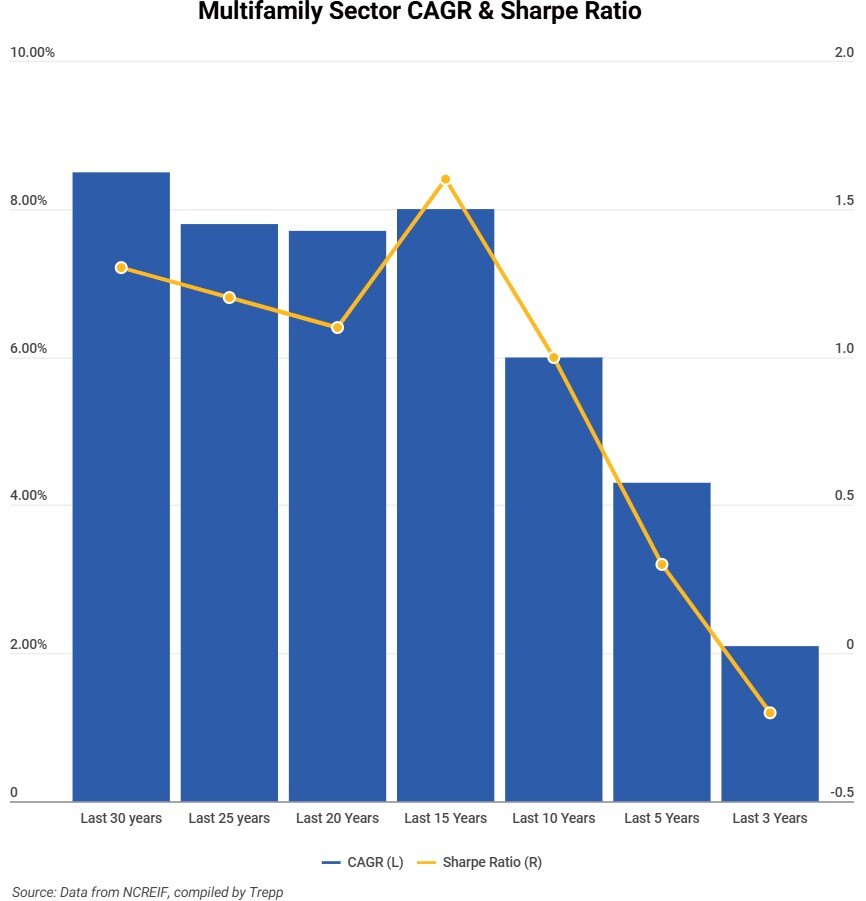

Over the past few years, multifamily investments have lagged behind long-term averages due to:

- Excessive New Construction: An oversupply of apartments has pressured cash flow.

- Increased Operating Expenses: Rising costs have squeezed profitability.

- Higher Interest Rates: These have made financing more expensive.

However, we’re beginning to see these pressures ease. As we look ahead to 2025 and beyond, the potential for higher cash flow and valuations in the multifamily sector is promising.

Why Now is the Time to Reallocate

I believe that now is the time to consider reallocating some of your gains from overvalued assets into commercial real estate, particularly multifamily properties. Here’s why:

- Strong Demand: The gap between renting and owning is not expected to close anytime soon.

- Easing Pressures: Factors that have been pressuring cash flow for apartment owners are receding.

At CREE Capital, we are diligently evaluating our target markets for attractive opportunities. The multifamily sector is poised to be a lucrative investment in the coming years.

Final Thoughts from Rod Khleif

As we wrap up this discussion, remember that successful investing is about being proactive, not reactive. Diversification and strategic timing are your allies in navigating the complexities of the market.

Take a moment to assess your portfolio. Are you positioned to weather the next storm? Are you ready to seize opportunities in multifamily investments? The time to act is now. Let’s make 2025 a year of growth and prosperity together!

Want to learn more about where to invest and how to scale your multifamily portfolio?

Want a Mentor Who’s Done What You Want to Do?

Check out Rod’s coaching program.

The fastest way to succeed in multifamily real estate is by learning directly from someone who’s been there, done that. With Rod Khleif’s Multifamily Real Estate Coaching Program, you get:

✅ Personalized guidance from a top real estate investing coach

✅ Step-by-step strategies to find deals, raise capital, and scale

✅ Access to a powerful network of successful investors