Get Your Deal Approved – Understanding How a Lender Underwrites a Multifamily Loan Request

Despite the fact that the approval criteria are remarkably similar, retail banks and lenders are frustratingly inconsistent with their multifamily loan approval decisions. One bank may look at a deal and want nothing to do with it, while another may be happy to lend the money. Naturally, this begs the question, why?

read more

To answer that question, we’re going to review 4 key elements of the loan underwriting process and provide actionable advice that’ll put you in the best position to get your multifamily deal approved. Let’s start with the key players involved in the transaction.

Note: Real Estate and Multifamily are specialized subjects that contain technical terms. To assist in the understanding of the subject matter contained in this article, we’ve provided a glossary of key terms (in bold) at the end.

Understanding the Key Players

From the point of initial contact, your loan request will pass through several hands before a decision is made; however, only a few of those individuals have critical input into the approval decision.

As a borrower, the first, and sometimes only, person that you’re likely to encounter is the Relationship Manager. Their job is to bring in new deals and shepard them through the approval process. They act as your advocate and the most experienced among them know how to “play the game” to get their deals approved. Remember though, they’re sales people and sometimes they can be overly optimistic about your deal’s chances so it’s best to take their words with a grain of salt.

The Loan Underwriter is the individual responsible for taking the property documentation from the Relationship Manager and “running the numbers” to determine if the cash flow generated by the property is sufficient to repay the proposed loan. They’ll write up their findings in an approval document and forward it to the Credit Officer.

The Credit Officer is the decision maker. Typically, they’re a senior executive, have a deep understanding of the bank’s Credit Policy and the trust of the board to independently make loan approval decisions. Depending on the size of your request, the loan may have to go through several credit officers before final approval.

As a borrower, it’s unlikely that you’ll have any interaction with the Credit Officer, but they’re the most important person in the approval process. To improve your chances of getting an approval, get to know the Relationship Manager and Underwriter and establish an open dialogue so they can ask you direct questions about the deal.

Understanding the Credit Policy

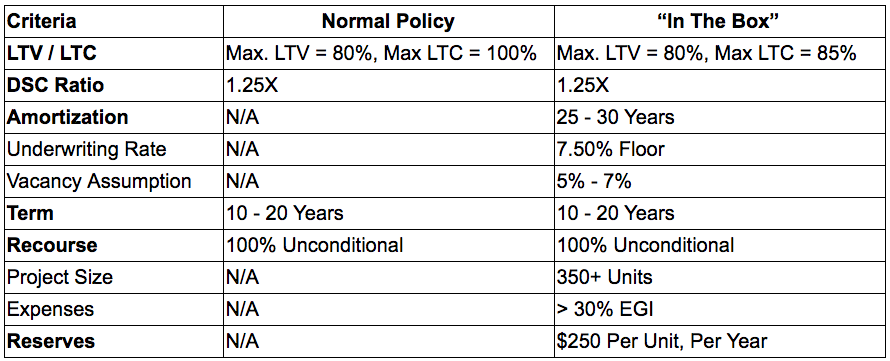

Whether you’re working with a traditional bank or specialty lender, everyone’s going to be making approval decisions based on a written Credit Policy. Below is an example of a major bank’s multifamily lending policy:

There are three things about this credit policy example worth highlighting:

- The policy serves as the basis for a Credit Officer’s decision and the best Relationship Managers will know the policy inside and out and guide you towards a structure that fits within the approval framework. Conversely, if there’s no hope of shaping the deal to the approval framework, they’ll be honest and send you elsewhere.

- There aren’t a lot of specifics with regard to the approval policy. The key aspects such as LTV, DSC, and Term are explicitly defined, but the rest of the terms are subject to interpretation. The “In the Box” column highlights the bank’s preferences, which can change at any given moment. In fact it’s the “In the Box” criteria that are responsible for much of the inconsistency between lenders.

When working with your Relationship Manager, ask them what their Credit Policy approval criteria look like. If your deal doesn’t fit, don’t waste your time.

Credit Approval Framework – The 5 C’s of Credit

Let’s assume your deal makes it through the initial screen and the loan package ends up on the Underwriter’s desk. To evaluate the deal, they’re going to use a specific framework, colloquially known as “The 5 Cs.” Let’s look at each one individually and what they mean for your deal:

Character

As the borrower, your character is a critical component in the transaction. Are you trustworthy? Do you have a good reputation? Have you successfully repaid loans as agreed in the past? To determine your character, the lender will look at things like credit reports, overdraft activity, and market reputation to ensure you’re a trustworthy borrower.

[1] It may not be called “In the Box” with all institutions, but each lender will have some level of stated policy and preferred loan parameters, which are subject to change.

Master the Character component by working hard to get to know your Relationship Manager so that you can demonstrate your trustworthiness. If you have any hiccups in your past such as a bankruptcy or foreclosure, be open about them and be prepared to explain how this request is different.

Capacity

The Capacity of the property to repay the proposed loan may be the most critical element of the deal and it comes down to one simple question, does the property proforma generate enough cash to repay the proposed loan? To determine the capacity of the deal, the Underwriter will look at a wide array of financial metrics including rents, expenses, reserves, vacancy assumptions, comparable rents, historical performance, and future expectations. They’ll take all of these metrics and create their own repayment model, which may or may not differ significantly from your own.

Master the capacity component by using your understanding of the bank’s credit policy to create a realistic proforma that the bank will accept. Be clear about each line item and how you derived the value. Be conservative in your assumptions and detailed in your analysis. Present your findings in an easy to understand format and be prepared to answer any questions the underwriter may have.

Capital

How much of your own capital are you injecting into the deal? As a borrower and investor, you’re highly incentivized to use as little of your money as you can get away with. However, the bank wants to know that you’re invested in the deal and that you aren’t going to walk away if things get rough.

Master the capital component by clearly explaining where your equity contribution is coming from and why you’re committed to the deal for the long haul. NOTE: There’s an important difference between your money and investor money that you’ve pooled for an equity contribution. If you’re leading the group, demonstrate to the bank that you’re personally invested in the deal.

Conditions

This is a little more macroeconomic than deal specific, but the bank is going to carefully consider multifamily market conditions at the time the loan request is made. To assess this, they’ll look at things like rental trends, occupancy rates, job creation, migration patterns, income levels, competition and wage growth.

Master the conditions element by demonstrating to the bank a clear understanding of why the macroeconomic environment and sub-market conditions are favorable for your proposed purchase. Source your data and provide plenty of charts and graphs to support your argument.

Collateral

Lastly, the bank is going to perform detailed analysis on the proposed to collateral in an effort to answer one question, if you default on the loan and the bank has to liquidate the property, can they do it for enough to repay the outstanding loan balance? To determine this they’ll commission a 3rd party appraisal and take a close look at the intangibles that can make the property attractive to potential buyers. These include things like location, ingress/egress, parking, amenities, security, condition, recent renovations, landscaping, unit mix, and unit layout.

To master the collateral component, put together a document package on your proposed loan that outlines all possible details on the property, including each of the elements mentioned above. In addition, do the research on your competition and come to the lender with a point of view on where your property stacks up against others in the sub-market.

Non-deal related considerations

In some cases, you may present the bank with a deal that meets credit policy, is “in the box” and covers all of the 5-Cs that still gets declined. How? There are two non-deal considerations completely out of your control to be aware of.

If you’re working with a retail bank, they have to abide by regulatory limits on the composition of their loan portfolio and they may not have any room left in their “multifamily bucket” at the time of your application. It has nothing to do with you or your deal, but it could still sink your chances. Be sure to ask your Relationship Manager at the outset if they currently have “appetite” for multifamily deals.

In addition, each lender subscribes to reports, newsletters, and economic forecasts that shape their view of the multifamily market. If the lender you’re working with has a negative outlook on the multifamily asset class in general, there may not be much you can do to change their mind, no matter how good the deal is.

If your deal gets declined, be sure to ask why. If it’s for one of these two reasons, don’t waste your time appealing the decision. Look for another lender to work with.

Conclusions

Remember, at the end of the day you’re dealing with people who have different opinions and institutions that have different policies and regulatory requirements. Both of these factors are at the root of the seemingly inconsistent decision making.

To put yourself in the best position to get the deal approved, invest the time to get to know Relationship Managers from multiple lenders, quiz them on their policy and “in the box” requirements, and push them to be honest. When it comes time to underwrite the deal, remember the “5-Cs” and present the lender with a loan package that is detailed, thorough, presentable, and reasonable.

Glossary of Key Terms

Relationship Manager: A lender’s Relationship Manager is their sales person. Their primary job is to originate loans where the borrower and collateral have an acceptable level of risk. If working with a retail bank, it’s also the Relationship Manager’s job to originate new deposit accounts.

Loan Underwriter: The Loan Underwriter works in the lender’s credit department and their job is to analyze potential loan transactions, document their risks, and make an initial approval/denial recommendation.

Credit Officer: The Credit Officer is a critical role in the loan origination process as they’re the individual who has the ultimate approval/denial authority. Their job is to examine the underwriter’s analysis and decide whether or not to approve a loan request.

NOTE: A lender may have several credit officers with varying levels of approval authority. The bigger the deal, the more likely that it’ll have to go through multiple Credit Officers before final approval.

Credit Policy: A lender’s Credit Policy is a written document that defines the terms and conditions under which the lender is willing to extend credit. When contemplating their approval/denial decision, it’s the Credit Officers job to do so in compliance with the written Credit Policy.

Loan To Value (LTV): The Loan to Value ratio is the percentage of a property’s appraised value that a financial institution is willing to lend. It’s calculated as the loan amount divided by the property’s value.

Loan to Cost (LTC): The Loan to Cost ratio is the percentage of a property’s cost that a financial institution is willing to lend. It’s calculated as the loan amount divided by the property’s cost. It’s typically used in construction lending where the cost represents the budgeted cost to construct the property.

Debt Service Coverage Ratio (DSCR): The Debt Service Coverage ratio is a metric used to indicate how a property’s cash flow relates to the annual loan payments. It’s calculated as the Net Operating Income divided by the annual loan payments.

Net Operating Income (NOI): Net Operating Income is a measure of a property’s cash flow. It’s calculated as a property’s revenue minus operating expenses.

Amortization: Amortization is a tool used to spread a loan’s payments over time. In multifamily lending, it’s expressed as the number of years required to reduce the loan balance to $0, given a defined payment.

Loan Term: The Loan Term is defined as the number of months for which loan payments may be made. If a loan is “Fully Amortizing” than the Term and Amortization are the same and the loan balance will be $0 at the end of the term. Iin multifamily lending, it’s common for the Term and Amortization to be different to allow for lower payments (and positive cash flow). But, it also means that there’s a balance at the end of the Term.

Vacancy: In multifamily lending, Vacancy is defined as the percentage of unoccupied units and it’s calculated by dividing the number of vacant units by the total number of units in the property. For example, if a property had 100 units and 5 of them are vacant, then the vacancy is 5%.

Recourse: If a loan has “recourse,” it means that it requires the personal guarantee of the loan sponsor(s). If a loan is “non-recourse” than no guarantee is required.

Reserves: Reserves are monies set aside for future maintenance costs. In multifamily lending, it’s common for a lender to require $250 per unit, per year in reserves.