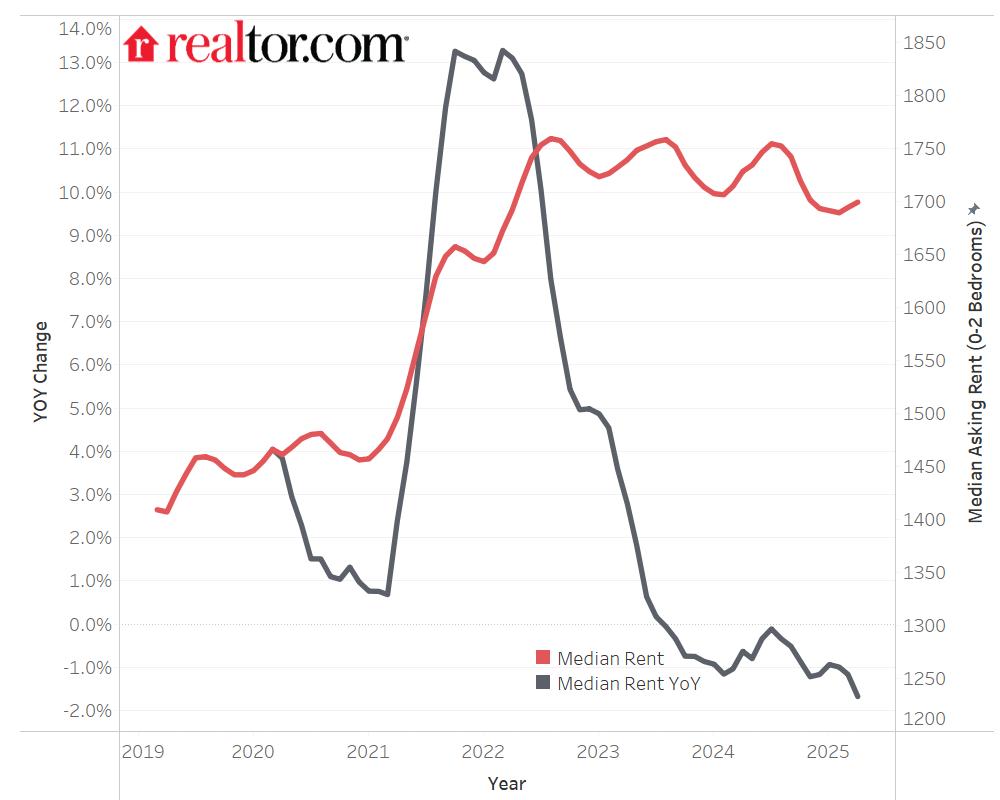

In today’s U.S. housing market, renters face relentless pressure from rising home prices and higher costs of living, even though new supply of rental units has finally caught up in some regions. As of April 2025, the national median asking rent price stood at $1,699. This has shown a slight $5 uptick month-over-month but down 1.7 percent year-over-year from last spring . Meanwhile, the national rental vacancy rate climbed to 7.1 percent in Q1 2025, its highest level since 2018, offering a rare window of relief for affordable housing seekers .

In this deep dive, we will look at five metro areas where housing costs are lowest for renters. We will examine each real estate market’s vacancy rates, rent trends over the years, and cost-of-living factors. By the end of this article you should have a better idea of the best markets to buy real estate in 2025.

Why Does Affordability in Rental Units Matter?

Understanding affordable rental markets isn’t just about finding a cheap apartment. It’s a strategic lens for investors and renters alike to balance cash flow, risk, and long-term growth in the broader real estate market:

-

Lower Barrier to Entry for investors means acquisition prices better align with achievable cap rates in stable metros.

-

Reduced Tenant Turnover occurs when rents stay in line with wages, minimizing vacancy costs and demolition of rental income.

-

Resilience Against Higher Costs as inflation and energy expenses rise, metros with modest housing costs offer more predictable long-term performance.

-

Value-Add Opportunities abound in markets where basic rents are low but employment growth remains strong. This makes targeted renovations and premium upgrades lucrative.

Top 5 Affordable Rental Markets

1. Oklahoma City, OK

-

Median Rent: $994 (April 2025)

-

Rent-to-Income Ratio: Roughly 16.7 percent of median renter income

-

Vacancy Rate: Approximately 8.6 percent (South region average)

-

Why It’s Affordable: A diversified local economy anchored by energy, aerospace, and healthcare keeps job growth steady while construction of new rental units outpaces demand. Cost-of-living in OKC remains 15 percent below the national average, cushioning residents against higher costs elsewhere. Source.

2. Austin, TX – Round Rock ,TX – San Marcos, TX

-

Median Rent: $1,470 (April 2025)

-

Rent-to-Income Ratio: About 17.2 percent

-

Vacancy Rate: Roughly 8.6 percent (South region average)

-

Why It’s Affordable: Despite its reputation as a tech hub, aggressive permitting of multifamily developments has tempered rent growth. The metro’s sustained inflow of remote workers and startups delivers long term tenant demand and steady home price appreciation. Home prices are projected to rise 3.7 percent this year without the extreme rent spikes seen in other tech markets. Source.

3. Columbus, OH

-

Median Rent: $1,210 (April 2025)

-

Rent-to-Income Ratio: Around 18.0 percent

-

Vacancy Rate: Approximately 7.6 percent (Midwest region average)

-

Why It’s Affordable: With Ohio State University as its anchor and a growing finance sector, Columbus has a great combination of stable rental unit absorption with modest home price gains. The year-over-year home-price growth has been 3.4 percent. This plus a strong tenant base and sensible zoning create a dependable pipeline of new inventory without overheating. Source.

4. Raleigh, NC – Cary, NC

-

Median Rent: $1,489 (April 2025)

-

Rent-to-Income Ratio: Roughly 18.2 percent

-

Vacancy Rate: 9.0 percent, one of the highest among growth metros

-

Why It’s Affordable: Known as the ‘Research Triangle,’ its booming life-science and tech employment drives demand, yet recent multifamily completions have lifted vacancy rates. That supply surge gives renters leverage and investors a chance to add value through interior upgrades and amenity enhancements. Source.

5. Minneapolis, MN -Bloomington, WI

-

Median Rent: $1,497 (April 2025)

-

Rent-to-Income Ratio: Approximately 18.5 percent

-

Vacancy Rate: About 7.6 percent (Midwest region average)

-

Why It’s Affordable: A diversified economy spanning healthcare, retail, and manufacturing shields the Twin Cities from ‘boom-bust cycles.’ Vacancy rates have ticked up as new units come online, softening rent growth year over year. Zillow’s rent index shows a 3.4 percent increase nationally but flat to modest gains here .

Deep Dive Into Key Metrics

To evaluate any metro’s fundamentals, focus on these core indicators:

-

Year-Over-Year Rent Trends

Nationally, median asking rent has eased 1.7 percent year-over-year even as it remains 20.8 percent above pre-pandemic 2019 levels . This cooldown signals an inflection point in the rental real estate market, where affordability is beginning to return.

-

Vacancy Rates

A national rental vacancy rate of 7.1 percent in Q1 2025 marks the highest vacancy since mid-2018 . Regionally, the South leads with an 8.6 percent vacancy, followed by the Midwest at 7.6 percent, the West at 5.9 percent, and the Northeast at 5.1 percent . Higher vacancy rates often give tenants more power to negotiate. This leads to slower rent growth, which is important in affordable housing markets.

-

Home Prices & Cost of Living Dynamics

Home prices are forecast to rise 3.7 percent in 2025, while shelter costs in the consumer price index continue to climb despite rent pressures moderating . In metros where home-price growth outpaces rent hikes, investors can pursue 1031 exchange strategies to roll gains into larger assets without sacrificing yield.

-

Supply of Rental Units

New multifamily completions have surged, especially in Sun Belt metros. Zillow projects multifamily rent growth of just 1.6 percent over 2025, a signal that higher supply is finally reining in rents .

Investment Strategies for Affordable Markets

Finding value in affordable metros demands rigorous due diligence and a multifaceted approach:

-

Stress Test Your Projections: Model scenarios with occupancy dips of 5 percent, expense inflation of 10 percent, and cap-rate expansion of 50 basis points.

-

Conservative Leverage: Aim for loan-to-value ratios no higher than 65 percent on stabilized assets and 75 percent on value-add plays to preserve cash flow during downturns.

-

Capitalize on Tax Advantages: Use cost segregation to front-load depreciation and shield cash flow, and plan 1031 exchanges for seamless portfolio growth.

-

Execute Value-Add Initiatives: Focus on basic interior renovations, like modernizing kitchens and bathrooms, or improving common areas to justify rent bumps in affordable housing stock.

-

Align Hold Period With Cycles: A 5-7 year hold balances equity growth from cap-rate compression against cyclical risk. Track vacancy rates and home-price momentum to time any refinance or sale.

Key Takeaways About Best Housing Markets to Buy Real Estate

-

Identify Target Metro Areas using tools like the Realtor.com Rental Report and Zillow’s Observed Rent Index to pinpoint metros with low rent-to-income ratios.

-

Underwrite Deals Weekly to sharpen your market sense. Evaluate at least two properties each week, factoring in local vacancy data and cost of living indexes.

-

Build Local Relationships with brokers, property managers, and municipal planners to uncover off-market opportunities where rental units trade below replacement cost.

-

Leverage Technology such as market analytics platforms for real-time tracking of home-price changes, rental listings, and vacancy trends.

-

Raise Capital Strategically by illustrating how your chosen metro’s affordability metrics translate into stable long-term returns and resilient cash flow for investors.

Center your strategy on metros where rent remains a manageable share of income. This will help you not only tap into affordable housing demand but also unlock sustainable equity growth. Make sure you underwrite conservatively, stay alert to vacancy rate shifts, and align your exit strategy with broader housing market cycles.

Ultimately, the most affordable rental markets in 2025 aren’t about the ones with the lowest rents, they’re the resilient metros where rental units, vacancy rates, and home prices meet to deliver long-term opportunities for both investors and tenants alike.

Disclaimer: This article was created with the assistance of AI and reviewed by Rod Khleif and his team to ensure accuracy and relevance.