Measuring Returns: Understanding How IRR Works

When considering an investment in a multifamily property, one of the first questions that an investor may ask themselves is, “If I invest in this property, what is the return I can expect on my investment?”

read more

IRR is designed to measure the compound annual rate of return an investor can expect on their investment…

For a multifamily property, there are a variety of ways to measure returns, but one of the most commonly accepted and most misunderstood is called the Internal Rate of Return or IRR. IRR is designed to measure the compound annual rate of return an investor can expect on their investment and we’re going to discuss it in detail in this article.  Note: Real Estate and Multifamily are specialized subjects that contain technical terms. To assist in the understanding of the subject matter contained in this article, we’ve provided a glossary of key terms (in bold) at the end. Click here to get my FREE Multifamily Toolbook!

Note: Real Estate and Multifamily are specialized subjects that contain technical terms. To assist in the understanding of the subject matter contained in this article, we’ve provided a glossary of key terms (in bold) at the end. Click here to get my FREE Multifamily Toolbook!

Calculating IRR

IRR is the rate earned on each dollar invested for each time period it’s invested in. That second part of the definition is a critical one, “…for each time period it’s invested in.” There’s a time component to IRR that can’t be ignored because it accounts for the compounding of returns. IRR is often used as a proxy for the interest rate and mathematically speaking it’s calculated as the rate of return that sets the Net Present Value of all future cash flows (positive of negative) equal to zero.

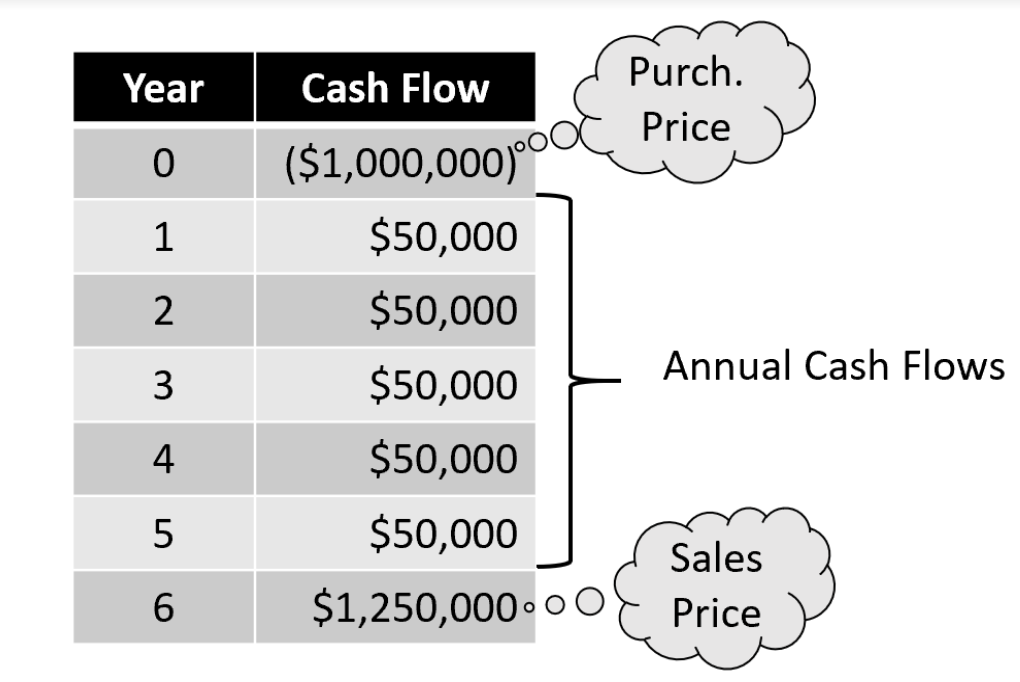

To illustrate this concept, consider the following series of cash flows. Assume a purchase price of $1MM, annual net cash flows of $50,000 and a sale for $1.2MM at the end of a 6 year holding period (year 6 also has $50,000 cash flow). It looks like this:

To calculate the IRR, it’s easiest to put the cash flows in a spreadsheet and use the function for IRR to calculate the answer. Doing so returns the discount rate at which the NPV of this series of cash flows is equal to $0. It’s ~7.7%.

To check this, use the same series of cash flows with the NPV function. For the discount rate, use the answer to the IRR function and, if you’re right, the answer should be $0

Pros of Using IRR as a Tool for Measurement

As a tool for measuring the return on your property, there are several advantages to using IRR.

IRR is a good metric to account for the time value of money, which is the concept that a dollar received today is worth more than a dollar received in the future, due to its earning potential. This is where the time component comes in.

In addition, IRR is a simple metric that can be used to compare investments of a similar time horizon. For example, if you’re trying to decide between three different properties with the same holding period, IRR is a good way to compare the return potential for each. This isn’t just limited to comparing real estate investments, IRR can also be used to compare non-traditional investments (like real estate) to traditional ones like stocks or bonds, as long as the time horizon is the same.

While IRR is useful, it isn’t perfect. When using IRR, there are a few limitations to be aware of.

Cons of using IRR as a tool for Measurement

Remember the importance of time in the IRR equation? It contributes to one of the major flaws with IRR, it can’t be used to compare projects with different holding periods. If you’re comparing a real estate investment with a 5 year holding period to a bond investment with a 10 year holding period, IRR is useless.

Further, IRR doesn’t measure the absolute return on an investment. For example, a $100M investment that returns $105M in 1 month works out to an IRR of ~80%, which seems great. But, the absolute return is just $5M, which isn’t as good. Lastly, IRR doesn’t consider the cost of capital. Rationally, you only want to consider projects with an IRR that exceeds your cost of capital. If the project has an IRR of 10%, but your cost of capital is 15%, then the deal probably isn’t worthwhile.

For these reasons and others, IRR is best used as one of several metrics to compare investment opportunities. To illustrate this idea, let’s look at an example.

Example

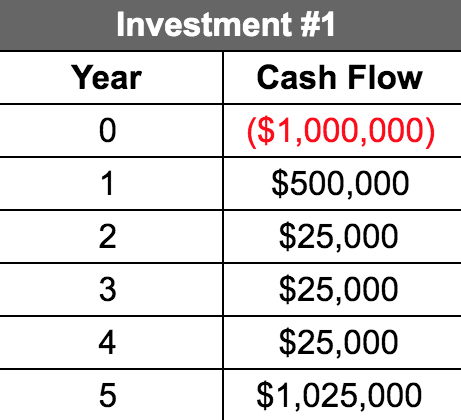

Year 0 cash flow represents a purchase price of $1MM. Because it’s an outflow, it’s shown as a negative number. Years 1-4 show a series of cash inflows based on the proforma and sale occurs in year 5.

To calculate the Net Present Value of this opportunity, a discount rate is required. The discount rate that results in a Net Present Value of $0 is the internal rate of return.

Rather than go through the complicated math of the calculation, it’s easiest to use the IRR function in a spreadsheet to calculate the answer. The input would look like this:

=IRR(Cash Flow 0, Cash Flow 1, Cash Flow 2, Cash Flow 3, Cash Flow 4, Cash Flow 5)

The result is 14.78%. If the IRR exceeds the cost of capital by an acceptable margin than it’s an indication that the project may be worth pursuing. But remember, the IRR only makes sense if the income and expenses on the proforma are reasonable and accurate.  In addition, it’s only one data point in the investment evaluation process. It shouldn’t be used in isolation.

In addition, it’s only one data point in the investment evaluation process. It shouldn’t be used in isolation.

Conclusion

When evaluating investment returns, IRR is a key metric that can be used to measure the success of an investment. It’s useful in a variety of different scenarios, but has limitations. For this reason and others, it shouldn’t be used to evaluate an investment in isolation. It should be used as a part of a suite of metrics that tell the entire story of the opportunity.

Glossary of Key Terms

Internal Rate of Return (IRR): The rate of return earned on each dollar, for each period of time that it’s invested in. It’s calculated as the rate that sets the Net Present Value of an investment’s cash flows (positive or negative) equal to zero.

Net Present Value (NPV): The present value of a series of cash flows is the current value of a future stream of income given an expected rate of return. Thus, the Net Present Value is the difference between the present value of future cash inflows and future cash outflows.

Holding Period: An investor’s holding period is defined as the amount of time for which they plan to hold an investment. It’s usually expressed in either months or years.

Time Value of Money: A financial concept which dictates that a dollar available today is worth more than a dollar available in the future, due to its ability to earn interest. It’s the fundamental concept behind IRR.

Cost of Capital: For a multifamily syndicator or lead partner, the cost of capital describes the total blended rate required to acquire funds for the project. If only debt is used, it may be equivalent to the interest rate on the debt. However, if some combination of debt and equity is used, it would be the blended cost of both.