The $65M Savannah Deal That Got Away: Lessons in Multifamily Deal Analysis and Conservative Investing

When it comes to multifamily deal analysis, staying disciplined in underwriting and risk assessment is crucial for long-term success. While we actively pursue opportunities in Savannah, Georgia, one recent deal slipped through our fingers—but not for lack of effort.

During our acquisition pipeline meeting, our team identified a 372-unit portfolio with a $65 million whisper price. The deal had strong potential, but after in-depth underwriting, due diligence, and financial modeling, we determined it wasn’t worth the risk. This breakdown of the multifamily deal analysis will show why we walked away, the underwriting assumptions we made, and what investors should always look for when evaluating opportunities.

Multifamily Deal Analysis

We’ve talked about how much we like Savannah, Georgia, and we’ve been actively pursuing deals in the area. One recently slipped through our fingers, and we thought you might like to hear about it.

Our acquisition team brought this opportunity to our attention during our standing pipeline meeting, mentioning that the “whisper price” was $65 million. These meetings always begin with a visual review of the property. We check the location, nearby amenities, and crime levels. We also evaluate the building’s appearance. Finally, we look at unit sizes, bedroom types, and washer/dryer hookups. If the property passes the initial review, we move forward with underwriting.

Property Overview

The deal included 372 units across three properties. This offered some savings, but not as much as if they were all in one place. The buildings were built in the late 1980s to early 1990s. They had $38.5 million in fixed debt. The interest rate was 2.71%, and there are seven years left on the loan.

During due diligence, we identified several capital expenditure (CAPEX) concerns:

- All buildings needed new roofs, a significant cost given their 30+ year age.

- 16 units were in the process of being rebuilt after a fire, adding complexity to the deal.

- While most apartments had been renovated, 30-50% still needed additional work.

- Given these factors, we budgeted $6 million for CAPEX.

Underwriting the Deal

We reached out to an independent local property manager to review T-12 expenses and recommend an achievable budget. Meanwhile, we secured insurance quotes, which came in between $1,450 and $1,650 per door, and requested an estimate of future property taxes from the city, landing at $1,600 per door.

For rent growth projections, Costar estimated 3-5% annually for the next five years. We incorporated this data into our model and made the following key adjustments:

- Increased expenses by 8% to account for inflation and potential operational inefficiencies.

- Factored in a 7.7% interest rate on additional financing beyond the assumable debt.

- Modeled an exit cap rate of 5.0%, slightly above Costar’s projection of 4.8% in five years.

When buyers get excited about a deal, there’s a temptation to be overly optimistic. Our experience has taught us that erring on the side of caution produces better risk-adjusted returns.

Competitive Bid Process

The first key date in any deal is the initial offer deadline. We were told that 25 groups were reviewing the deal and likely to submit offers. The highest bids would advance to “best and final”, where the seller squeezes buyers for every last dollar.

We settled on an offer of $58 million, a number we believed would deliver solid returns with minimal risk.

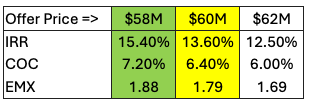

You Can See the Returns That Our Model Delivers

At the best and final breakpoint (yellow) and at $62 million, the most probable accepted price, our model produced the following internal rate of return (IRR) estimates:

- $58M offer: Solid IRR with low risk

- $62M offer: 12.5% IRR, likely not attractive to investors

Clearly, the eventual buyer, if they plan to market this deal to investors, won’t attract capital with a 12.5% IRR. To make the deal look better, they will likely market an IRR in the 15-17% range. The only way to reach those numbers is to assume higher revenue growth and lower expenses—assumptions we weren’t comfortable making.

Investors should always ask syndicators:

- What assumptions were used to achieve these projected returns?

- Are revenue growth and exit pricing realistic?

- How do operating expenses compare to market norms?

Higher projected returns always come with higher risk, and we prefer to stay disciplined in our underwriting.

Why We Walked Away

Our close rate on deals is very low, and that’s by design. We’re okay missing out on deals because we prioritize capital preservation and risk-adjusted returns over just adding properties to our portfolio.

- We won’t overpay based on aggressive projections.

- We only acquire deals that align with our conservative investment approach.

- We ensure every acquisition meets our strict underwriting principles.

Savannah remains a market we like, and we will continue evaluating opportunities. But not at the expense of responsible investing.

Final Thoughts

The Savannah deal illustrates why conservative underwriting matters. It’s easy to get caught up in bidding wars and market hype, but overpaying for deals rarely ends well.

- 25% of tenants are delinquent on rent, making rent growth projections risky.

- Over $100 million in back rent is owed, affecting landlord cash flow.

- Foreclosures in the market are rising, creating additional uncertainty.

- Developers and investors are becoming cautious, making future liquidity uncertain.

If the right deal comes along, we’ll move quickly, but we will never stretch our numbers to make a deal work.

For investors, this serves as a reminder to carefully evaluate underwriting assumptions, question projections, and prioritize downside protection.