What It Means for the Economy & Real Estate

The US Labor Department recently reported that the economy added 256,000 new jobs in December. This news affected the financial markets. This surge in US job growth prompted the Federal Reserve (FED) to signal a more cautious approach to future rate cuts, aiming to prevent inflation spikes.

The stock market and real estate investments reacted poorly to the news. Both had been counting on lower interest rates in 2025. Job creation is often viewed as a good sign for the economy. However, it is important to know where these jobs are being added. Understanding the long-term effects is crucial for investors, business owners, and property markets.

Last year, public perception of the economy often conflicted with government reports. While many Americans felt financial strain, officials pointed to strong job numbers as proof of economic growth. However, where these jobs are created matters, and a deeper analysis raises concerns about the long term stability of the labor market.

US Job Growth: Private Sector vs. Government-Funded Sectors

Private sector job growth is a positive economic indicator because it reflects business expansion and consumer demand. In contrast, excessive growth in government and publicly funded sectors, such as healthcare and social assistance, can signal an economy that is overly reliant on taxpayer dollars rather than sustainable business profits.

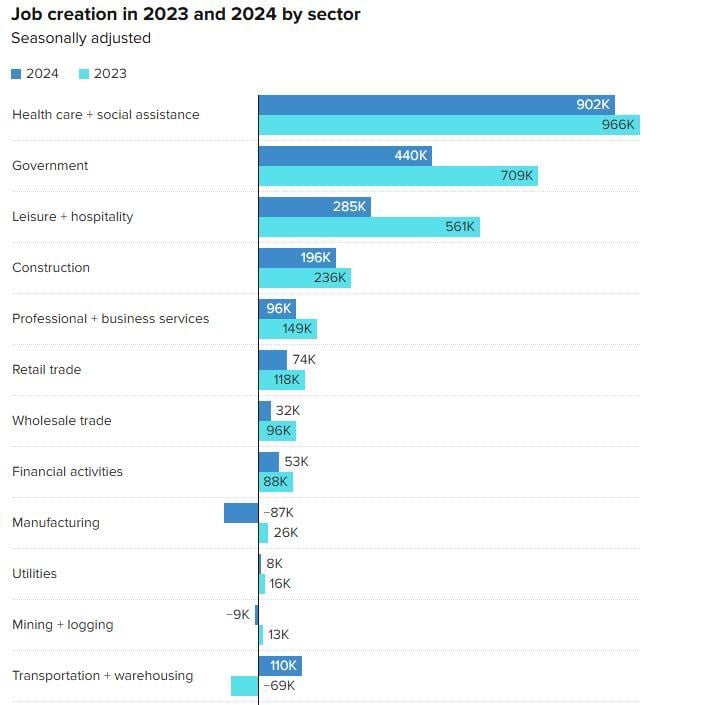

The data over the past two years highlights this trend:

- Healthcare, social assistance, and government jobs accounted for 60% of all new jobs created.

- Private sector job growth has lagged behind, raising concerns about long-term economic productivity.

The question remains: Are new jobs driving economic expansion, or are they simply increasing the tax burden and healthcare costs? Higher taxes and rising healthcare expenses reduce the capital available for business growth, slowing the economy in the long run.

The Hidden Stress in the System

Despite the administration’s optimistic outlook, underlying economic indicators suggest growing financial strain. The Senior Loan Officer Opinion Survey (SLOOS), a report by the Federal Reserve, tracks trends in private lending markets. The latest survey reveals that:

- Banks report weak demand for commercial and industrial loans across all business sizes.

- Lending standards for small businesses are tightening due to an uncertain economic outlook.

When businesses struggle to access capital, expansion slows, job creation weakens, and economic momentum declines.

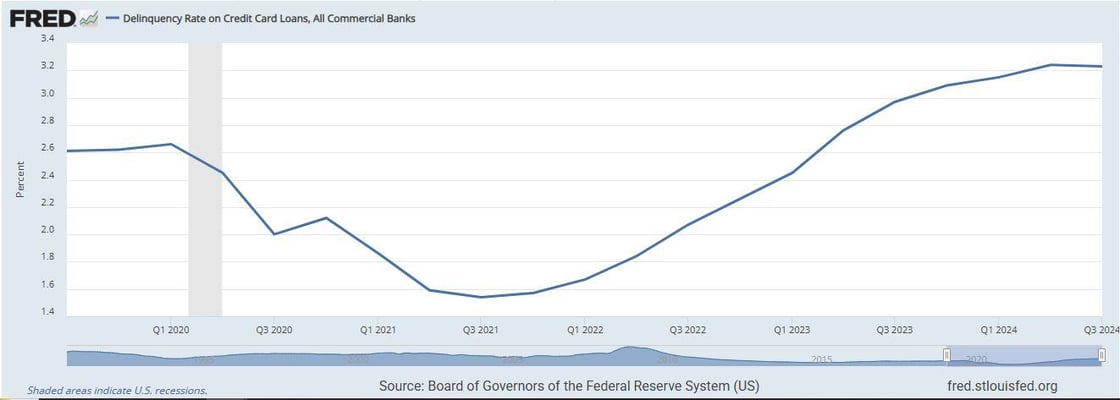

Consumer Debt & Rising Delinquencies

Another key concern is the increasing financial distress among consumers. Credit card delinquency rates have been rising, reflecting financial hardship for many Americans.

- Banks are tightening lending standards for lower-credit borrowers, limiting access to additional funds.

- More consumers are taking out higher credit card loans and requesting limit increases, signaling financial strain.

At the property level, this financial pressure is evident. Some tenants in multifamily properties are struggling to pay rent, as they lack the savings to handle unexpected expenses. Lael Brainard, Director of the American Economic Council, recently noted, “All Americans are confronting higher prices, but the burden is particularly great for households with more limited resources.”

What This Means for Interest Rates & Real Estate Investments

Despite the strong headline job numbers, the broader economic picture remains fragile. As the Federal Reserve evaluates the economy beyond just job reports, it is likely that interest rates will continue to decrease in 2025.

- SOFR (Secured Overnight Financing Rate) is expected to drift lower from its mid-4% range.

- Lower interest rates should increase transaction activity in the multifamily real estate sector.

For real estate investors, this shift could provide opportunities to secure lower financing rates, drive investment activity, and boost property values.

While job numbers dominate headlines, the true economic landscape is more complex. Understanding the interplay between employment trends, lending conditions, and interest rates is essential for making informed real estate investment decisions in 2025.