|

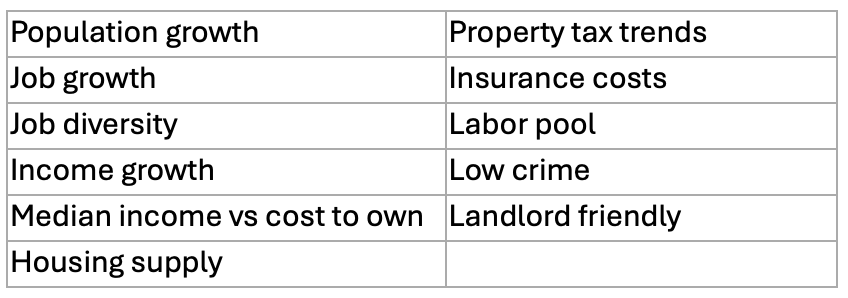

As part of our ongoing series of sub-market analysis, today we will discuss Phoenix, AZ. We have not bid on any deals in the city due to a number of factors detailed below. What we look for in a sub-market: |

|

|

Phoenix, AZ Statistics: Phoenix has turned into the “darling of the US innovation elite.” City leaders for decades have courted tech and auto manufacturers to invest in the city. Their efforts have paid off as Taiwan Semiconductor and Intel are currently building new semiconductor plants set to open by 2028. The $40B in investments tops all other states in the US, and it is expected to add 20K new jobs. The city also has an active EV manufacturing footprint, including autonomous vehicle developer Waymo. And the city boasts more computer and math workers than 95% of all other US cities, so the brain power exists to support the new businesses. With these announcements, Phoenix checks the “job growth” box big time! Phoenix is the 5th largest city in the US, with 1.6M people. The greater Phoenix MSA boasts 4.7M people. A few years back, Phoenix was the fastest growing city in the country, but more recently population growth has been falling (1.6% in 2020 to 1.3% in 2023). The median household income is $72K (versus $75K nationally), while the median house costs $422K. To afford a home in the area, you would need to earn ~ $134K per year. And the average rent is just over $1,350 a month. Tenants would need to earn $54K to afford the typical apartment, so this indicates that rental housing is affordable for the average family while starter homes are out of reach for many. Over the past few years, construction of new apartments has skyrocketed, leading to concessions and increased vacancy. From the graph below, you can see that rents increased over 60% from 2018, which attracted capital and development of new apartments. However, since Q4 2022, rents have been falling. |

|

|

In Q1 2024, 6,100 new units were completed and a record 5,600 were leased. In the pipeline, there are 131K new apartments either under construction or in the planning stage. Through 2026, it is estimated that an additional 6.4% of existing apartment stock will come to market. Vacancy is projected to rise from the current 8.7%, and rents are projected to continue to fall through 2024 and beyond. In seven Phoenix submarkets, new construction is over 20% of existing housing supply, which may be hard to lease up. Other Concerns: Evictions: Water: CRIME: In summary, Phoenix will continue to experience growth pains for real estate investors as excess supply will continue to outstrip demand for the foreseeable future. Investors should plan on muted rent growth and increasing vacancy for the next few years. Longer term, the potential for a lack of water supply could limit population growth. For these reasons, we are not currently looking for opportunities in Phoenix. |