Here’s Why Multifamily Investors Should Take Notice

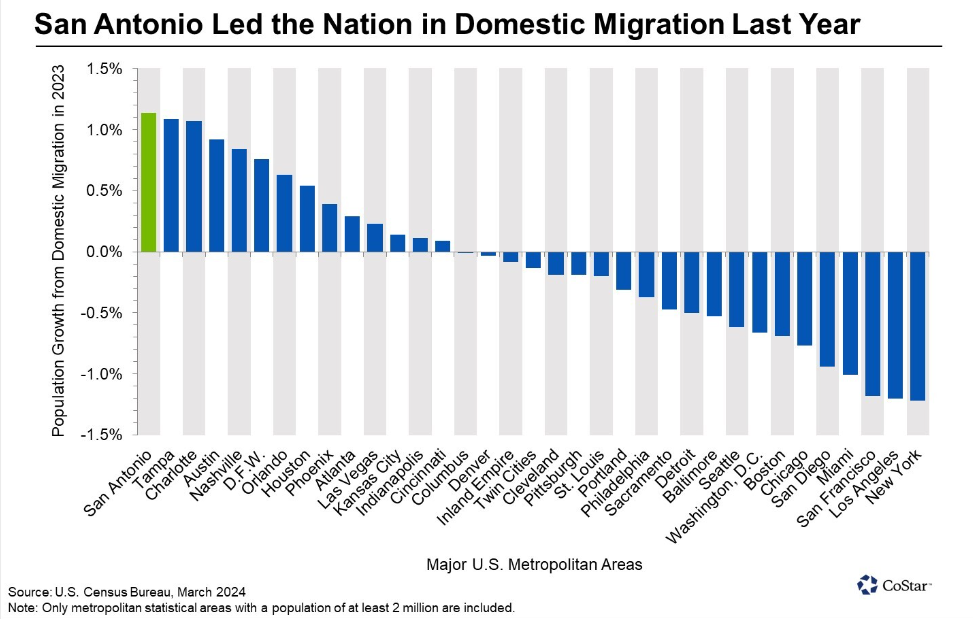

San Antonio is booming! According to the U.S. Census Bureau, San Antonio ranked #1 among the nation’s 35 largest cities for domestic migration in 2023, with 30,379 people relocating from other states. And, this surge is no fluke. Since 2020, the city has grown by an impressive 5.27% Now it’s the 3rd fastest growing metropolitan area in the country.

For multifamily investors, this is the kind of trend you can’t afford to ignore. A rising population means rising demand for rental housing. When you combine that with job growth, affordability, and top-tier amenities, you get a perfect storm for cash-flowing multifamily investments.

Why San Antonio Is a Magnet for Migration

San Antonio is attracting families, professionals, and businesses from across the country. But what’s driving this growth?

1. A Thriving Job Market

The city boasts a diverse and expanding economy, with industries such as healthcare, cybersecurity, aerospace, manufacturing, and military sectors fueling job creation. Major employers like USAA, H-E-B, Valero, and Toyota continue to expand, bringing stability and upward mobility for residents.

With strong employment opportunities, people are moving to San Antonio not just for a fresh start but for long-term career prospects and economic stability, which is a key driver for sustained rental demand.

2. Affordable Housing in a Major Metro

Unlike cities like Austin, Dallas, or California’s overinflated markets, San Antonio still offers affordable living. The median home price remains below national averages, making it one of the last major cities where people can live comfortably without breaking the bank.

For multifamily investors, affordability is a goldmine. High home prices push more people toward renting, increasing occupancy rates and keeping rental income strong.

3. Big-City Amenities Without the Big-City Hassle

San Antonio is the best of both worlds. It’s a vibrant urban lifestyle without the congestion and high costs of cities like New York, Los Angeles, or Chicago. Residents enjoy:

✔ A strong arts and culture scene with historic landmarks, museums, and theaters

✔ Premier entertainment & sports (Go Spurs!)

✔ Outdoor and recreational attractions (River Walk, parks, golf courses)

✔ Top-tier education options with excellent public and private schools

Quality of life is one of the biggest factors driving migration trends, and San Antonio delivers in every category.

What This Means for Multifamily Investors

Now, here’s where things get really exciting for investors.

Multifamily Market Group (MMG) projects that demand will significantly outpace new supply through 2025 and 2026. That’s right, net absorption is increasing, and vacancy rates are set to drop.

✔ More people = More renters

✔ Limited supply = Higher rental rates

✔ Strong job market = Lower tenant turnover

This dynamic creates a prime opportunity for savvy multifamily investors to acquire assets in a high-growth, high-demand market.

Our Latest San Antonio Acquisition—Why We’re All In

We’ve loved San Antonio’s multifamily market for years. Since acquiring our first asset three years ago, we’ve been actively searching for the right deal to expand our portfolio.

We’ve been patient—bidding conservatively, underwriting rigorously, and waiting for the perfect opportunity. And now, we’ve landed it.

We are thrilled to announce that we’ve secured The Regatta, a prime multifamily asset in a fantastic location. This property features large units, incredible value-add potential, and an opportunity to restore it to top-tier status.

Even better? Having another property under our management umbrella allows us to leverage our market knowledge, operational efficiencies, and local expertise.

This is exactly the kind of high-growth, high-reward opportunity we look for, and San Antonio’s booming market made it an easy decision.

Final Thoughts: Why You Shouldn’t Sleep on San Antonio

For multifamily investors, timing is everything—and San Antonio is a market you should be watching closely. With:

✔ Nation-leading population growth

✔ A strong job market fueling demand

✔ Affordable housing that keeps rental markets strong

✔ A limited supply of new apartments, driving rent appreciation

…San Antonio is positioned to be one of the hottest multifamily investment markets in the coming years.

If you’re serious about scaling your multifamily portfolio, you need to be strategic, proactive, and ready to capitalize on opportunities before the masses catch on.

The #1 Multifamily Investing Event!

Ready to Build Your Multifamily Empire? 🚀

Join Rod Khleif’s Multifamily Bootcamp, the top event for serious investors, where expert investors answer your questions and share proven strategies. Learn directly from industry leaders and take your investing to the next level!

🎟 Reserve Your Spot Now!