|

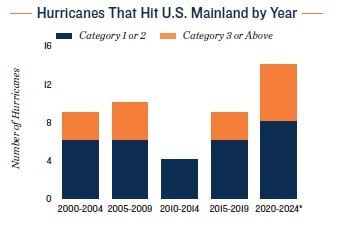

Our hearts and minds are focused on all of the people suffering from hurricane Helene and now those being threatened by hurricane Milton. Some models have Milton hitting Florida from the west. The damage from the storm surge and wind could devastate an area still cleaning up. Hurricane Helene wreaked havoc well inland across Georgia, the Carolinas, Tennessee, Kentucky and Virginia with massive rain and flooding. Helene highlighted how vulnerable wide swaths of the country are to flooding even those that aren’t in a designated flood zone. And it isn’t just hurricanes, wildfires, tornados, excessive rain, hailstorms and earthquakes are also in the news. |

|

|

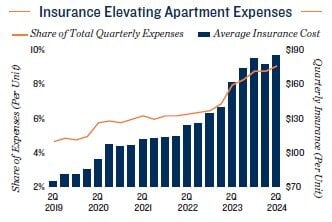

The loss of life and property are the primary concern as we face these weather events. But after the storm hits and the cleanup begins the financial impact rears its ugly head. Marcus & Millichap just issued a special report on rising insurance rates, and they noted that in some parts of Florida multi-family insurance costs have risen over 200% since 2019. The cost of rebuilding and the frequency and severity of the storms continues to push rates higher. On average insurance accounts for 9% of operating expenses for multi-family operators. In areas prone to natural disasters insurance can run as high as 16%. Higher insurance costs are pressuring net operating income and ultimately valuations and with these two storms it will only get worse. |

|

|

We are working with our insurance brokers to combine policies across properties to lower overall premiums and have had some success, but it is critical to underwrite insurance costs conservatively. Also, as part of your due diligence, evaluate the property for vulnerability to natural disasters. We can’t avoid a black swan event but as investors we should be aware of all the risks we are taking and appropriately factor them into our business plan. |