Converting Offices to Apartments: Benefits and Barriers

You’ve probably noticed empty office buildings sitting idle in your city. With national office vacancy rates climbing to 18.6%, and Morgan Stanley estimating a massive housing shortage of 5-6 million units, repurposing office buildings into apartments seems like a no-brainer. These conversions not only increase housing supply but also rejuvenate downtown districts and enhance local tax revenues. Yet, why aren’t more of these conversions happening?

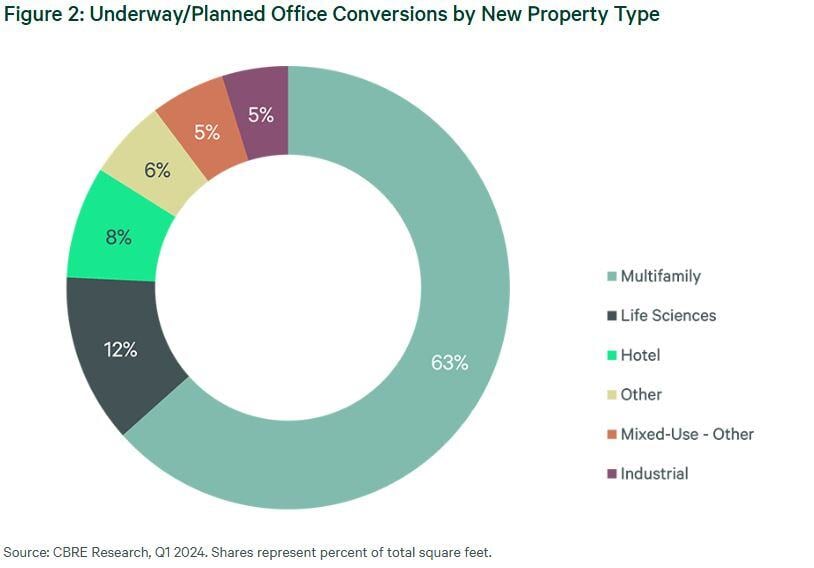

Current Trends in Office-to-Apartment Conversions

Across the U.S., about 120 office-to-apartment conversions (often called O2R) are currently underway. Once completed, these will produce roughly 31,000 new apartments. Between 2016 and 2023, there were about 45 conversions per year on average, generating approximately 22,000 apartments total. Although this is an increase from previous years, when compared to the 500,000 new apartments built annually, conversions represent just around 1% of the total supply. Clearly, this strategy isn’t having the widespread impact many hoped it might.

The Ideal Buildings for Apartment Conversion

A critical barrier limiting conversions is the lack of suitable office buildings. According to CBRE, ideal conversion candidates typically:

- Are smaller buildings, less than 14,000 sq. ft. per floor

- Were constructed before 1980

In successful conversions studied by CBRE, the median building was constructed around 1941, with approximately 13,000 sq. ft. per floor. Unfortunately, only about 1.1% of office spaces in the U.S. fit this “small, old, downtown” criteria. Modern office buildings, usually built after 1980, tend to have larger floor plates that don’t allow sufficient natural light to reach interior spaces—making apartment conversions impractical.

For perspective, in Manhattan, CBRE identified only 18 buildings meeting these specific criteria as viable conversion candidates.

Why Office-to-Apartment Conversions Often Don’t Add Up Financially

Beyond finding suitable buildings, financial feasibility remains a significant obstacle. According to CBRE:

- New apartment construction typically costs around $588 per sq. ft.

- Converting an existing office to apartments averages $685 per sq. ft.

The higher cost of conversions primarily stems from:

- Acquisition expenses

- Architectural redesign and code compliance

- Major alterations to plumbing, electrical, and HVAC systems

- Installation of residential partitions and finishes

Moreover, office leases typically last longer than residential leases, complicating and increasing the cost of vacating these properties for conversion.

Cities Encouraging Office-to-Apartment Conversions

Despite these challenges, several municipalities are recognizing the benefits and actively encouraging conversions. For example:

- New York City launched the “Office Conversion Accelerator Program,” providing guidance through complex regulatory processes and building codes. NYC is also revising zoning laws to simplify conversions.

- San Francisco recently passed legislation exempting office-to-apartment conversions from transfer taxes, aiming to incentivize property owners.

Yet, without more substantial government incentives, widespread conversions remain unlikely.

Will Conversions Help Solve the Affordable Housing Crisis?

Unfortunately, conversions currently show limited potential to alleviate affordable housing shortages. High conversion costs and limited suitable properties mean developers typically target high-end apartments rather than affordable units. Unless significant financial incentives or subsidies become available, it’s improbable that conversions will significantly impact affordable housing shortages.

Converting offices into apartments holds appealing promise for cities and developers alike. Still, structural and economic challenges make broad adoption difficult. While a valuable tool in multifamily investing, office-to-apartment conversions require careful evaluation and realistic expectations.

Investors and municipalities must align incentives and regulations clearly to fully realize conversions’ potential benefits.