|

|

Reports |

Is JPMorgan Too Optimistic About the Economy? (Q3 2024 Reality Check)

You’ve probably heard the news: JPMorgan, one of America’s top banks, recently reported declining profits for Q3 2024. But despite this drop, their outlook on the U.S. economy remains surprisingly upbeat. So what’s really going on?

Let’s break it down clearly:

Consumer Spending: Strong or Stretched?

Yes, consumer spending is still robust—at least, that’s what JPMorgan’s latest earnings report says. But let’s dig deeper:

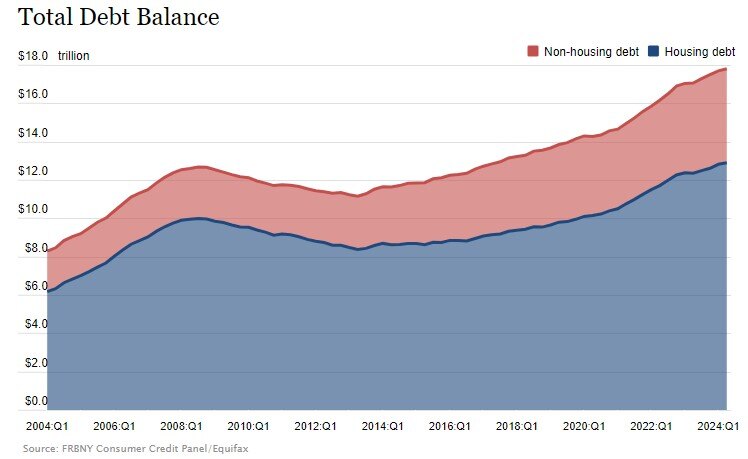

- Credit card debt is soaring, now totaling a staggering $1.1 trillion after jumping another $27 billion last quarter.

- Home equity loans rose by $4 billion—the ninth consecutive quarterly increase.

- Auto loan debt surged $10 billion, reaching $1.6 trillion.

What does this mean?

Simply put, many consumers aren’t spending money they have—they’re spending money they borrowed. Cash reserves are dwindling, debt is mounting, and in some markets, home values are dropping. This isn’t exactly the strong foundation we’d hope for.

Banks Are Feeling the Strain

If consumer spending seems strong, why did JPMorgan’s profits decline 31% compared to the previous year?

The main culprit? Credit card losses.

And JPMorgan isn’t alone. Wells Fargo also reported rising credit card losses, openly stating:

“Some consumers are feeling stretched, particularly lower-income individuals.”

It’s clear: consumer debt and financial strain are beginning to affect banks significantly.

Business Confidence: A Tale of Two Worlds

JPMorgan painted a rosy picture of business confidence, but there’s more to the story:

- Wells Fargo notes that many companies are reluctant to build inventory or invest in capital improvements.

- Business bankruptcies surged by 40% from June 2023 to June 2024.

- The FED business confidence index has stabilized but remains significantly below its 2021 peak.

Perhaps JPMorgan’s optimism is focused exclusively on large corporations. Meanwhile, smaller businesses—the backbone of the economy—are clearly struggling.

Remember, business confidence is vital. It drives wage growth and employment, both essential for a healthy multifamily investing environment.

Job Creation: Are the Numbers Reliable?

JPMorgan highlights “strong job creation,” but recent data revisions tell a different story:

- In August, the U.S. Bureau of Labor Statistics revised job creation figures downward by a massive 800,000 jobs.

- All these “missing jobs” belonged to the productive private sector. Ironically, the government, education, and healthcare sectors, areas often criticized for inefficiency, did not see such revisions.

Adding government jobs doesn’t drive economic innovation or real value creation; it usually leads to increased deficits or higher taxes.

The Bottom Line

JPMorgan’s positive economic outlook seems overly optimistic when you look beneath the surface. Consumer spending is financed by rising debt, small businesses face substantial pressures, and the job market isn’t as robust as previously thought.

As investors, particularly in multifamily real estate, understanding the real economic landscape—not just surface-level optimism—is essential for informed decision-making.

Stay alert, stay informed, and always question the narrative.