Is the Stock Market Set to Crash? Signs Investors Should Watch

The stock market has been on a remarkable run since 2022, fueled largely by explosive growth in the technology sector. While rapid gains may seem promising, history has shown that market bubbles can burst just as quickly as they inflate. The dot-com boom of the late 1990s is a perfect example—when telecom and internet stocks soared to unsustainable levels, the market crashed, wiping out 40% of investors’ equity.

With artificial intelligence (AI) stocks now driving the market higher, many are asking: Is the stock market set to crash?

Tech Stocks and Market Bubbles: Lessons from History

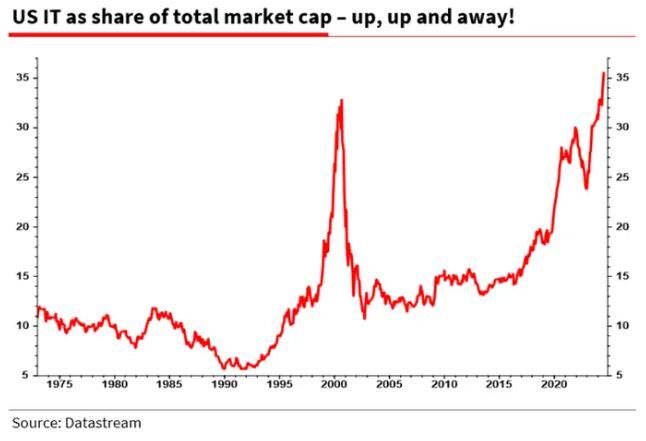

A closer look at technology sector dominance in the S&P 500 reveals a concerning pattern. Historically, the sector has represented 10-17% of the total S&P 500 valuation. However, during the late 1990s, telecom and internet stocks surged to 35%, pushing valuations to extreme levels before a sudden crash.

Fast forward to today, and we see a similar trend.

- Tech stocks currently trade at 32X forward earnings estimates, an extremely high valuation.

- Earnings growth would need to hit 30% year-over-year to justify these valuations, yet recent growth has averaged only 20%.

- Investor sentiment remains fragile, if expectations aren’t met, a major sell-off could follow.

Many equity analysts are raising red flags, cautioning that the current tech boom may be overextended, just as the dot-com bubble was before its collapse.

Why a Diversified Portfolio Is Critical

Periods of high market volatility highlight the importance of portfolio diversification. A well-balanced portfolio includes a mix of:

- Equities (stocks)

- Bonds

- Cash reserves

- Alternative assets

- Real estate investments

While stocks remain a key part of any portfolio, overexposure to one sector—such as technology—can increase risk. Having diversified, uncorrelated assets can help cushion losses in the event of a stock market crash.

Why Real Estate Is a Strong Hedge Against Market Volatility

Historically, real estate investments have provided strong risk-adjusted returns that are uncorrelated to stock market performance. Among commercial real estate asset classes, multifamily real estate stands out as one of the best long-term investments.

Why? Because, unlike offices, retail stores, or hotels, people always need a place to live.

A stock market downturn could push more people toward renting instead of homeownership, increasing demand for multifamily properties. This makes real estate investments an essential part of a well-rounded portfolio, particularly during uncertain market conditions.

Final Thoughts: Is the Stock Market Headed for a Crash?

While no one can predict the exact timing of a stock market crash, the warning signs are there—high valuations, overreliance on tech stocks, and optimistic earnings assumptions that may not hold up. For investors, the key takeaway is to stay diversified, manage risk, and consider alternative assets like real estate to protect long-term wealth.

Want to learn more about how real estate can strengthen your portfolio? Explore the benefits of multifamily investing as a hedge against market volatility.