The Fast-Track Guide for First-Time Multifamily Investors

Calculating returns shouldn’t feel like brain surgery. When I bought my first property back in 1981, I had a handheld calculator, a yellow pad, and a whole lot of optimism. Today you’ve got better tools—and you’ve got this guide. I’ll walk you through how to calculate cash on cash return, explain what it does (and doesn’t) tell you, and call out the rookie mistakes that can turn a “great deal” into a slow bleed.

TLDR;

Cash-on-cash return equals annual pre-tax cash flow divided by total cash invested. Start with net rental income, subtract operating costs and debt service, then divide that figure by your down payment, closing costs, and capital reserves. The result, expressed as a percentage, shows your yearly cash yield on money actually deployed.

What is Cash on Cash Return?

Cash on cash return (CoC) is a simple way to measure the yearly cash income your investment produces. It applies to real estate or any asset that throws off cash. It’s calculated before taxes, and it answers one question: “How much cash did I get back this year based on the cash I actually put into the deal?”

Why Does Cash on Cash Still Matter in 2025

Cash-on-cash tells you how hard your dollars work every year—no fancy projections, no crystal ball. When rates, rents, and regulations can change fast, cash on cash return is one of the cleanest reality checks you’ve got.

New investors love chasing flashy IRR charts. But cash on cash tells you whether the property feeds you every month. And in 2025, with borrowing still tight in a lot of places, you don’t want a deal that only works “on paper.” You want spendable cash flow and a cushion for surprises—especially as insurance and operating costs keep climbing. HUD has noted insurance costs on assisted multifamily properties have nearly doubled over the last five years on average (HUD).

How Do You Calculate Cash on Cash Return?

The cash-on-cash equation is refreshingly simple—which also means if you mess it up, the mistake shows up fast. Learn it once and you’ll be able to evaluate deals anywhere.

Cash-on-Cash Return = (Annual Pre-Tax Cash Flow ÷ Total Cash Invested) × 100

Annual Pre-Tax Cash Flow = Net Operating Income (NOI) – Annual Debt Service

Total Cash Invested = Down Payment + Closing Costs + Initial Repairs/Reserves

A Real-World Example

Theory is nice. Real numbers are better. Here’s a simple example that looks a lot like what beginners see in today’s market. Follow the steps and you’ll quickly spot whether a deal is solid—or a money pit.

How to Calculate Cash on Cash Return Step-by-Step

-

Find NOI. Rents $120,000; expenses $45,000 → NOI = $75,000.

-

Subtract Debt. Annual mortgage payments $48,000. Cash flow = $27,000.

-

Add Total Cash In. $250k + $25k + $25k = $300,000.

-

Divide and Multiply. $27,000 ÷ $300,000 = 0.09 → 9 % cash-on-cash return.

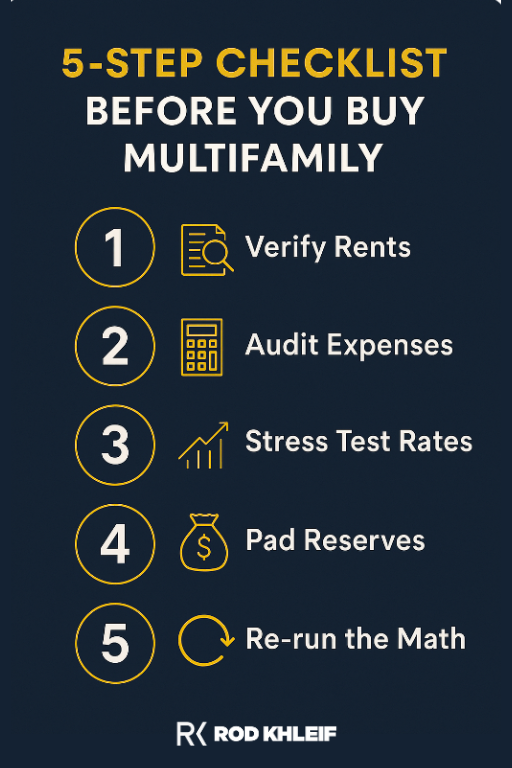

5 Step Checklist Before You Buy

Great returns start long before closing day. Run this checklist every time and you’ll sleep better, your investors will breathe easier, and your lender will treat you like a pro.

-

Verify Rents. Call competing properties; demand trailing-12 statements.

-

Audit Expenses. Insurance, taxes, and repairs creep up fast.

-

Stress-Test Rates. Model a 1-point interest bump on your loan.

-

Pad Reserves. Set aside at least $300 per unit, per year.

-

Re-run the Math. If cash on cash drops below 6 %, renegotiate or walk.

Common Rookie Mistakes

Experience is a brutal teacher—she gives the test before the lesson. Save yourself the scars by learning where beginners usually stumble.

-

Counting appreciation as cash. Appreciation is gravy, not dinner.

-

Ignoring capital expenditures. Roofs leak when spreadsheets don’t.

-

Underestimating vacancy. Budget at least 5 % even in hot markets.

-

Using fake pro-formas. Trust real rent rolls, not broker daydreams.

-

Forgetting taxes. Consult a CPA who understands real estate.

Advanced Move: Boosting Your Return

Once you’ve got the basics down, you can start turning the dial. These tactics can improve cash flow without gambling on “hope” or unrealistic rent growth.

-

Raise below-market rents after light value-adds (paint, LED lights, smart locks).

-

Refinance once NOI jumps—pull equity, lower the payment, or both.

-

Master RUBS (ratio utility billing) so you can pass water, sewer, trash, or other utilities through when it fits your market and the property setup.

On the right property, utility bill-backs can move the NOI needle quickly—because you’re not “raising rents,” you’re reducing owner-paid expenses (or creating reimbursed income) in a way residents already expect in many markets.

Internal Resources to Dig Deeper

Knowledge compounds faster than money. Use these tools and episodes to sharpen your edge between deals.

-

Crunch numbers with my Cap Rate Calculator

-

Learn exactly how to spot value in my Multifamily Syndication Guide

-

Hear investor success stories on the Lifetime Cash Flow Podcast

Key Takeaways

If you remember nothing else, tattoo these points on your investing brain.

Cash-on-Cash Is King. It measures real money in your pocket. If you’re investing in multifamily, you need to know how to calculate cash on cash return.

Use Real Numbers. Verify income, expenses, and debt terms.

Aim for 8 % or Higher. Anything less needs a crystal-clear upside plan.

Protect Liquidity. Keep reserves so surprises don’t kill returns.

Iterate Fast. Recalculate after every change—rent bumps, refinance, rehab, all of it.

Cash on Cash Return FAQ

What is cash-on-cash return?

Cash-on-cash return is a metric used in real estate investing to measure the annual return an investor earns on the actual cash invested into a property. Unlike cap rate, which looks at a property’s value, cash-on-cash return focuses on how much money you’ve personally put into the deal versus how much cash flow you’re getting back each year. For example, if you invest $100,000 of your own money into a property and it generates $10,000 in annual pre-tax cash flow, your cash-on-cash return is 10%.

How is cash-on-cash return calculated?

The formula is straightforward:

Annual Pre-Tax Cash Flow ÷ Total Cash Invested = Cash-on-Cash Return.

Cash flow is usually calculated after all operating expenses, property management, and debt service are paid, but before taxes. Total cash invested includes your down payment, closing costs, and any renovation or upfront expenses you put into the property.

Why is cash-on-cash return important for investors?

It’s one of the most practical metrics because it tells you how hard your money is working right now. Appreciation and tax benefits matter, but many investors prioritize ongoing cash flow. Cash-on-cash return helps you judge whether a deal supports your income goals—especially if you’re aiming to replace a salary or reach financial independence.

What is considered a “good” cash-on-cash return?

It depends on the market, the property type, and your risk tolerance. In many U.S. markets, investors aim for at least 8–12% cash-on-cash return on multifamily or small rentals. In hotter, more competitive markets, you might see lower returns (5–7%), while value-add deals in emerging markets can offer 12–20% or more.

What factors affect cash-on-cash return?

Several variables directly influence the return:

-

Financing terms: A lower interest rate or longer amortization can boost cash flow.

-

Operating expenses: High taxes, insurance, or maintenance costs eat into returns.

-

Vacancy rate: Fewer paying tenants lowers income and reduces return.

-

Rent growth: Properties with strong demand and increasing rents tend to improve returns over time.

-

Upfront investment: The more you invest upfront (larger down payment, costly renovations), the harder it is to achieve a higher percentage return.

How is cash-on-cash return different from ROI?

ROI (Return on Investment) measures total return over time, including appreciation, loan paydown, and tax benefits. Cash-on-cash return looks only at annual pre-tax cash flow compared to cash invested. It’s an income-focused metric, while ROI is a broader long-term performance measure.

Can cash-on-cash return change over time?

Yes. Rents can rise, expenses can shift, and mortgage payments can change if you refinance. A property might start at 7% cash-on-cash and climb to 10%+ as rents grow and the debt stays fixed. Value-add investors often target improvements that boost NOI and cash flow after renovations or repositioning.

Is cash-on-cash return the only metric investors should use?

No. It’s extremely useful for measuring short-term performance, but you should also consider cap rate, IRR, equity multiple, and market fundamentals. Cash-on-cash answers: “How much money is my cash making me right now?” It doesn’t capture long-term value growth, tax savings, or loan amortization.

How can I improve cash-on-cash return on a property?

You can increase return by raising rents, lowering expenses, refinancing into better terms, or negotiating seller concessions to reduce your upfront cash. Partnering, seller financing, or other creative structures can also lower out-of-pocket costs and increase the cash-on-cash percentage.

Should new investors rely heavily on cash-on-cash return?

Yes—but with context. For first-time investors, it’s a clear, tangible way to evaluate deals and avoid buying properties that look good on paper but don’t produce real income. At the same time, don’t ignore appreciation potential or tax advantages, which can justify a slightly lower cash-on-cash return if the long-term upside is strong.

Disclaimer: This article was written with the help of AI and reviewed by Rod’s team. Always consult a licensed professional.

Ready to Accelerate?

Subscribe to the Lifetime Cash Flow Podcast for weekly deep dives.

Seats are filling fast for my next Multifamily Bootcamp. Claim yours now → www.rodkhleif.com/bootcamp.

Let’s build lifetime cash flow together!

-Rod Khleif