For real estate investors looking to enter the multifamily market with minimal upfront capital, FHA multifamily loans can be an excellent way to get multifamily financing. These loans are backed by the Federal Housing Administration (FHA) and the Department of Housing and Urban Development (HUD). They offer easy terms for buyers. However, buyers much purchase 2-4 unit homes. They can live in one unit as their main home.

In this comprehensive guide, we’ll cover what multifamily loans are, how to qualify, their benefits and drawbacks, and strategies for maximizing their potential.

What is an FHA Multifamily Loan?

An FHA multifamily loan is a government backed mortgage. Unlike traditional investment property loans, FHA multifamily loans require the borrower to occupy one of the units as their primary home for at least one year. This is often referred to as owner occupied.

While FHA loans to buy multifamily properties don’t directly come from the government, they are insured by the FHA, which reduces risk for lenders and allows them to offer favorable loan terms. This makes it a desirable multifamily financing.

Key Features of FHA Multifamily Loans:

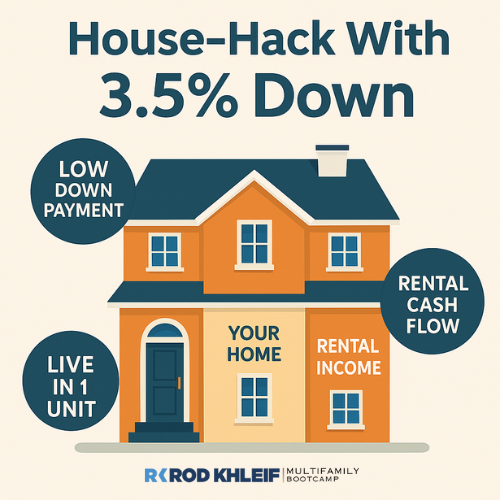

- Down Payment as Low as 3.5%: Compared to conventional loans, which often require 20-25% down, an FHA loan for multifamily property requires as little as 3.5% down for qualified borrowers.

- Fixed-Rate Mortgages Available: Borrowers can choose from 15-year or 30-year fixed-rate mortgages, offering stability in payments.

- Lower Interest Rates: FHA backed loans often come with lower interest rates than conventional loans.

- Flexible Credit Score Requirements: FHA loans are available to borrowers with credit scores as low as 580.

- Higher Loan Limits: The FHA loan limits for multifamily properties vary by location but are higher than those for single-family homes.

- Seller Concessions: Sellers can contribute up to 6% of the purchase price toward closing costs, reducing upfront expenses for buyers.

FHA Multifamily Loan Requirements

Before applying, borrowers must meet the FHA multifamily loan requirements, which include financial and occupancy criteria:

Financial Requirements:

- Credit Score: Minimum 580 for 3.5% down payment or 500-579 with 10% down.

- Debt-to-Income Ratio (DTI): FHA loans typically require a DTI ratio of 50% or less, meaning your total monthly debt obligations should not exceed 50% of your gross income.

- Employment and Income: Borrowers must demonstrate a steady income and at least two years of employment history.

- Loan Limits: The FHA loan limits for multifamily properties depend on location and are adjusted annually.

Occupancy Requirements:

- The borrower must live in one of the units as their primary residence for at least one year.

- The property must have between 2 and 4 units. Larger properties (5+ units) do not qualify under standard FHA multifamily loan guidelines.

Property Standards:

- The property must meet HUD’s safety and livability requirements.

- An FHA approved appraiser will inspect the home to ensure it meets minimum property standards before the loan is issued.

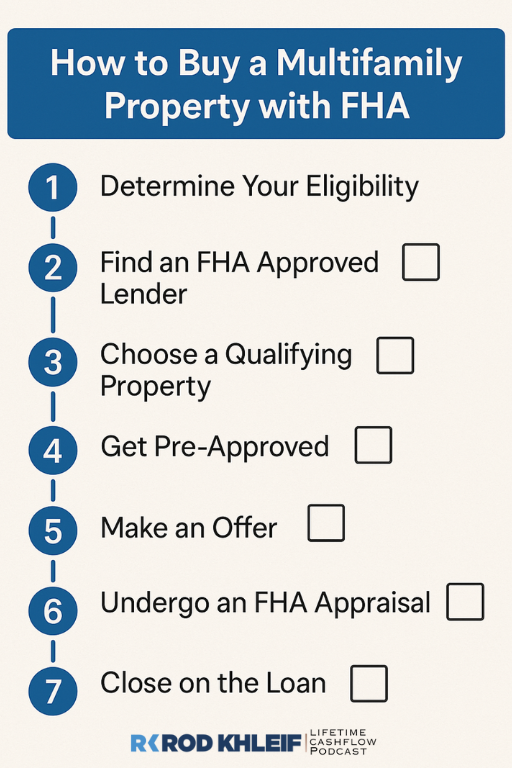

How to Buy a Multifamily Property with FHA

If you’re wondering how to buy multifamily property with FHA, here’s a step by step guide:

Step 1: Determine Your Eligibility

Check your credit score, income stability, and existing debts to ensure you meet FHA loan requirements.

Step 2: Find an FHA Approved Lender

Not all lenders offer FHA multifamily financing, so it’s important to find a lender with experience in FHA multifamily loans.

Step 3: Choose a Qualifying Property

- The property must be between 2 and 4 units.

- One unit must be occupied by the borrower as a primary residence.

Step 4: Get Pre-Approved

A pre-approval letter from an FHA lender will show sellers that you’re a qualified buyer.

Step 5: Make an Offer

Once you find a qualifying property, work with your real estate agent to negotiate an offer.

Step 6: Undergo an FHA Appraisal

The FHA approved appraiser will assess the home’s value and ensure it meets FHA multi unit guidelines.

Step 7: Close on the Loan

Upon final approval, close on your loan and move into one of the units as your primary residence.

Advantages and Disadvantages of FHA Multifamily Loans

Pros:

- Low Down Payment: 3.5% down makes entry into real estate investing accessible.

- Lower Interest Rates: Compared to conventional investment loans.

- Easier Qualification: Less stringent credit score and income requirements.

- Seller Concessions Allowed: Helps reduce closing costs.

- Build Wealth Through Rental Income: Other units generate cash flow to offset mortgage payments.

Cons:

- Mortgage Insurance Required: Upfront and monthly PMI payments add to costs.

- Owner-Occupancy Requirement: Borrower must live in one of the units.

- Property Restrictions: Must meet HUD’s safety and livability standards.

- Loan Limits Apply: The maximum loan amount varies by county and state.

FHA vs. Conventional Loans for Multifamily Properties

| Feature | FHA Multifamily Loan | Conventional Multifamily Loan |

|---|---|---|

| Down Payment | 3.5% | 15-25% |

| Interest Rates | Lower | Higher |

| Credit Score Requirement | 580+ | 680+ |

| Owner-Occupancy | Required | Not Required |

| Mortgage Insurance | Yes | No (if LTV < 80%) |

| Property Condition | Must meet FHA standards | More flexible |

Is an FHA Multifamily Loan Right for You?

An FHA multifamily loan is a great option for new investors. It helps them enter the multifamily real estate market. This loan offers low down payments and flexible lending terms. If you meet the owner-occupancy requirement and follow FHA loan rules, this loan can help you build wealth.

Take the Next Step

- Speak with an FHA approved lender to assess your eligibility.

- Research FHA loan limits in your area.

- Find a multifamily property that meets FHA multi unit guidelines.

Rod Khleif’s Expert Take: Why This Strategy Can Change Your Financial Future

Listen, if you’ve been dreaming of getting into multifamily real estate but thought you needed deep pockets, I’m here to tell you that an FHA multifamily loan could be the smartest move you ever make. I’ve coached thousands of investors, and time and again, I’ve seen people start with just 3.5% down, buy a 2-4 unit investment property, live in one unit, and let their rental properties cover their mortgage. That’s house hacking at its finest.

But here’s what makes it even more powerful, you’re not just reducing your housing costs, you’re actually building equity while someone else pays down your mortgage. This isn’t just about buying a primary residence, it’s about creating long-term wealth with cash-flowing assets that appreciate over time.

And if you’re worried about mortgage insurance or FHA loan restrictions, let me remind you: these are minor trade offs compared to what you’re gaining- a low-cost entry into multifamily investing, a chance to learn the business firsthand, and an opportunity to set yourself up for bigger deals in the future.

I started my journey in real estate with a small property, and it completely transformed my life. I’ve been through market cycles, seen interest rates rise and fall, and coached investors who’ve used this very strategy to build incredible portfolios.

So my advice? Don’t overthink it. If you’re serious about building wealth, take action. Talk to an FHA approved lender, find a qualifying property, and start your journey today. The sooner you get started, the sooner you’ll be on your way to financial freedom.

And remember, this is just the beginning. The goal isn’t to live in your investment property forever. It’s to use this stepping stone to leverage into bigger deals, short term rentals, or even commercial real estate.

If you’re ready to take control of your financial future, let’s make it happen. Check out my free resources, or grab a copy of my book, and let’s start building your legacy in multifamily real estate.

For more expert insights, follow Rod on Instagram.

Want a Step-by-Step Guide to Multifamily Investing?

Discover how top real estate investors build massive cash flow and financial freedom with multifamily real estate. In his book, How to Create Lifetime Cash Flow with Multifamily Real Estate Investing, Rod Khleif shares proven strategies to find deals, raise capital, and scale fast.

📘 Get Your Copy Here: Order the Book

By using FHA loans to buy multifamily, you can start building a strong real estate portfolio with minimal upfront investment and steady rental income!