FHA Multifamily Loan 2026: Complete Guide to FHA Multifamily Financing with 3.5% Down

Looking for FHA multifamily financing to buy your first 2-4 unit property in 2026? This comprehensive guide covers everything you need to know about FHA multifamily loans, from qualifying with just 3.5% down to closing your first cash-flowing investment property.

Table of Contents

- What is an FHA Multifamily Loan?

- FHA Multifamily Loan Requirements 2026

- How to Qualify for FHA Multifamily Financing

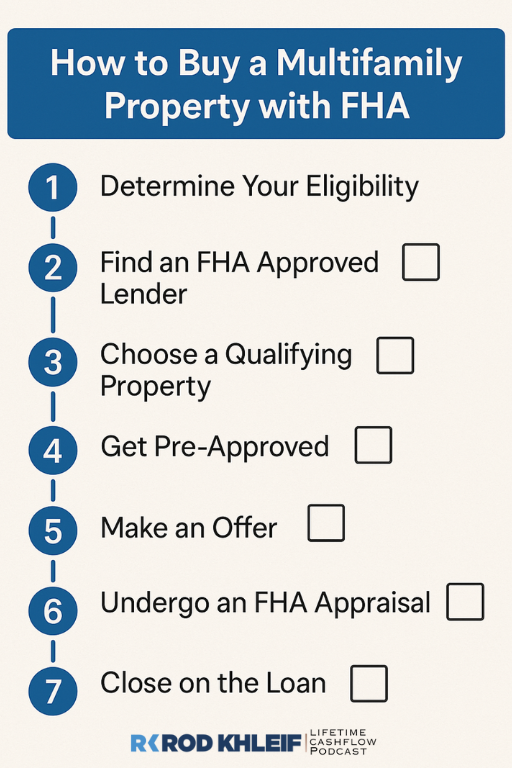

- Step-by-Step: How to Buy a Multifamily Property with FHA

- FHA vs. Conventional Multifamily Loans

- Pros and Cons of FHA Multifamily Financing

- 2026 FHA Loan Limits for Multifamily Properties

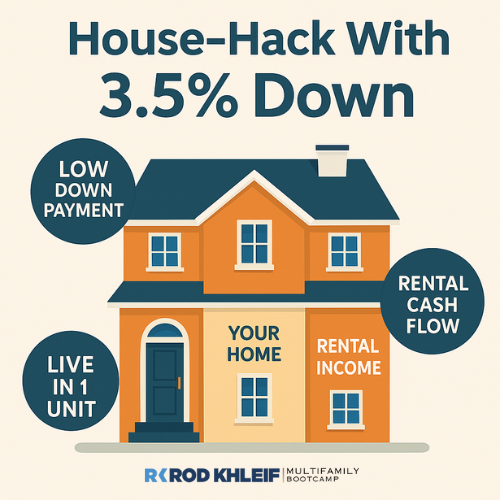

- Expert Strategy: House Hacking with FHA Financing

- Frequently Asked Questions

What is an FHA Multifamily Loan? Understanding FHA Multifamily Financing in 2026

An FHA multifamily loan is a government-insured mortgage program specifically designed for purchasing 2-4 unit residential properties with owner-occupancy requirements. Unlike conventional investment property loans that demand 20-25% down payments, FHA multifamily financing allows qualified borrowers to purchase income-producing real estate with as little as 3.5% down.

How FHA Multifamily Loans Work

These loans are backed by the Federal Housing Administration (FHA) and overseen by the Department of Housing and Urban Development (HUD). The FHA insurance reduces lender risk, enabling more favorable terms for borrowers—including lower interest rates, flexible credit requirements, and minimal down payments.

Critical requirement: You must occupy one unit as your primary residence for at least 12 months. This owner-occupancy mandate transforms your investment into what’s called “house hacking“—living in one unit while rental income from the other units covers your mortgage.

Key Features of FHA Multifamily Financing (2026)

✅ Down payment as low as 3.5% (vs. 20-25% conventional)

✅ Fixed-rate mortgages available (15-year and 30-year terms)

✅ Lower interest rates than conventional investment loans

✅ Credit scores starting at 580 (some lenders accept 500-579 with 10% down)

✅ Higher debt-to-income ratios allowed (up to 50% DTI)

✅ Seller concessions up to 6% toward closing costs

✅ Rental income counted toward qualification

2026 Update: FHA loan limits have been adjusted for inflation. Check your county’s specific limits as they vary significantly by market (discussed in detail below).

FHA Multifamily Loan Requirements 2026: Complete Qualification Checklist

Before applying for FHA multifamily financing, you must meet specific financial, occupancy, and property criteria. Here’s exactly what lenders evaluate:

Financial Requirements for FHA Multifamily Loans

1. Credit Score Requirements

- 580 or higher: Qualify for 3.5% down payment

- 500-579: May qualify with 10% down (lender discretion)

- Below 500: Generally not eligible for FHA financing

2026 Tip: Many lenders have overlays requiring 620+ credit scores even though FHA minimum is 580. Shop multiple FHA-approved lenders.

2. Debt-to-Income Ratio (DTI)

- Front-end DTI: Housing expenses ≤ 31% of gross monthly income

- Back-end DTI: Total debt obligations ≤ 43-50% of gross monthly income

Income advantage: Projected rental income from non-occupied units can be used to offset your DTI (typically 75% of market rent is counted).

3. Employment and Income Verification

- Minimum 2 years verifiable employment history

- Consistent income documented via pay stubs, W-2s, tax returns

- Self-employed borrowers: 2 years of tax returns required

- Multiple income sources: All must be documented and stable

4. Cash Reserves

- Minimum: Enough to cover down payment + closing costs

- Recommended: 2-6 months PITI reserves (especially for 3-4 unit properties)

Occupancy Requirements for FHA Multifamily Financing

🏠 You must occupy one unit as your primary residence for at least 12 months after closing

🏠 Property must be 2-4 units (duplex, triplex, or fourplex only)

🏠 You cannot own another FHA-financed property simultaneously

🏠 Intent to occupy must be genuine (FHA investigates occupancy fraud)

After 12 months: You’re free to move out and convert your unit to a rental, transforming the property into a fully cash-flowing investment.

Property Standards for FHA Multifamily Loans

The property must meet HUD’s Minimum Property Standards (MPS):

- Structurally sound with no major defects

- Safe electrical, plumbing, and HVAC systems

- Adequate heating in all units

- No peeling paint (lead-based paint concerns)

- Functional kitchen and bathroom in each unit

- Adequate access and egress (fire safety)

An FHA-approved appraiser will inspect the property and note any items requiring repair before loan approval. Unlike conventional loans, FHA requires all repairs to be completed before closing.

How to Qualify for FHA Multifamily Financing: Maximizing Your Approval Odds

Getting approved for an FHA multifamily loan requires strategic preparation. Here’s how to position yourself as a strong borrower:

1. Improve Your Credit Score Before Applying

Even though FHA accepts 580 scores, higher scores unlock better terms:

- 580-619: Maximum 3.5% down, higher interest rates

- 620-679: Better interest rates, more lender options

- 680+: Best rates, easiest approvals

Quick wins:

- Pay down credit card balances below 30% utilization

- Dispute errors on credit reports (use AnnualCreditReport.com)

- Become authorized user on someone’s well-managed account

- Don’t open new credit accounts before applying

2. Lower Your Debt-to-Income Ratio

With FHA multifamily financing, your DTI calculation includes projected rental income:

Example calculation:

- Gross monthly income: $6,000

- Existing debts: $800/month

- Proposed mortgage payment (PITI): $2,400

- Projected rental income (75% of $2,400): $1,800

DTI without rental income: ($800 + $2,400) / $6,000 = 53.3% ❌

DTI with rental income: ($800 + $2,400 – $1,800) / $6,000 = 36.7% ✅

Strategies to lower DTI:

- Pay off small debts completely

- Increase income (ask for raise, start side hustle)

- Choose properties with higher rental income potential

- Consider having non-occupant co-borrower

3. Save for Down Payment and Closing Costs

Minimum required:

- 3.5% down payment

- 2-5% closing costs (varies by location)

- 1.75% upfront mortgage insurance premium (can be financed)

On a $400,000 fourplex:

- Down payment: $14,000

- Closing costs: ~$10,000

- Total cash needed: ~$24,000 (before seller concessions)

Creative funding sources:

- Gift funds from family (allowed with proper documentation)

- Down payment assistance programs (state/local)

- Seller concessions (up to 6% toward closing costs)

- 401(k) loan (not recommended but possible)

4. Document Everything Thoroughly

FHA underwriting is documentation-intensive. Organize:

📄 2 years W-2s or tax returns

📄 2 months recent pay stubs

📄 2 months bank statements (all accounts)

📄 Proof of down payment source

📄 Explanation letters for any credit issues

📄 Rental income documentation (if applicable)

Step-by-Step: How to Buy a Multifamily Property with FHA Financing in 2026

Step 1: Determine Your FHA Multifamily Loan Eligibility

Before house hunting:

- Check your credit score (all 3 bureaus)

- Calculate your DTI with and without rental income

- Verify employment stability (2+ years same field)

- Assess cash available for down payment + reserves

Use this quick pre-qualification calculator:

- Monthly gross income x 0.43 = maximum total monthly debt payments allowed

- Subtract existing monthly debts = amount available for new mortgage

Step 2: Find an FHA-Approved Lender Specializing in Multifamily

Not all lenders offer FHA multifamily financing. Find one experienced with 2-4 unit properties:

✅ Ask: “How many FHA multifamily loans do you close per year?”

✅ Compare at least 3 lenders for rates and fees

✅ Verify they understand rental income calculations

✅ Check online reviews and licensing

Red flags:

- Lender seems unfamiliar with 2-4 unit FHA requirements

- Pushes you toward conventional loan instead

- Can’t explain how rental income affects qualification

Step 3: Get Pre-Approved (Not Just Pre-Qualified)

Pre-qualification = rough estimate based on what you tell lender

Pre-approval = lender verifies documentation and commits to loan amount

A strong pre-approval letter shows sellers you’re serious. For competitive markets in 2026, pre-approval is essential.

Step 4: Choose a Qualifying Multifamily Property

FHA multifamily financing property requirements:

✅ 2-4 residential units (duplex, triplex, fourplex)

✅ One unit suitable as your primary residence

✅ Meets HUD Minimum Property Standards

✅ In condition acceptable to FHA appraiser

✅ Purchase price within county FHA loan limits

Property hunting tips:

- Target neighborhoods with strong rental demand

- Analyze rental income (use Rentometer, Zillow Rent Zestimate)

- Calculate cash flow conservatively

- Factor in vacancy and maintenance (use 10% each as placeholder)

- Consider renovation potential (FHA 203(k) allows renovation financing)

Step 5: Make an Offer and Negotiate

Structuring your FHA multifamily financing offer:

- Earnest money: 1-3% of purchase price (shows commitment)

- Inspection contingency: Essential for FHA (appraisal will note repairs)

- Financing contingency: Protect yourself if loan falls through

- Seller concessions: Request up to 6% toward closing costs

2026 market tip: In slower markets, emphasize FHA benefits to sellers—these loans close reliably when buyers are qualified. In hot markets, consider offering slightly over asking or shortened contingency periods.

Step 6: Complete FHA Appraisal and Inspection

FHA appraisal includes:

- Market value determination (must meet purchase price)

- Property condition assessment (HUD standards)

- Required repair identification (must be completed before closing)

Common FHA appraisal issues:

- Peeling paint (lead-based paint concern)

- Missing handrails on stairs

- Non-functioning appliances

- Roof damage or missing shingles

- Plumbing or electrical deficiencies

Negotiating repairs:

- Seller completes repairs before closing (most common)

- Seller credits you at closing (you handle repairs)

- Price reduction to account for needed work

- FHA 203(k) loan includes renovation costs

Step 7: Close Your FHA Multifamily Loan

At closing you’ll:

- Sign loan documents

- Pay closing costs (minus seller concessions)

- Receive keys to your property

- Begin 12-month owner-occupancy period

First month action items:

- Move into your unit immediately

- Screen and place tenants in vacant units (if applicable)

- Set up property management systems

- Transfer utilities to your name

- Purchase landlord insurance policy

FHA Multifamily Financing vs. Conventional Multifamily Loans: 2026 Comparison

Choosing between FHA multifamily loans and conventional financing depends on your specific situation:

| Feature | FHA Multifamily Loan | Conventional Multifamily Loan |

|---|---|---|

| Down Payment | 3.5% | 15-25% |

| Interest Rates (2026) | 6.25-6.75% | 6.75-7.50% |

| Credit Score Minimum | 580 (some lenders 620+) | 680-700+ |

| DTI Ratio Max | 50% | 43-45% |

| Owner-Occupancy | Required (12 months) | Not required |

| Mortgage Insurance | Required (Upfront + Monthly MIP) | Required if LTV > 80% |

| Loan Limits | Varies by county | Higher (up to $2M+ depending on lender) |

| Property Condition | Must meet HUD standards | More flexible |

| Rental Income Used? | Yes (75% of market rent) | Yes (varies by lender) |

| Seller Concessions | Up to 6% | Up to 3% |

| Closing Timeline | 30-45 days | 21-30 days |

| Best For | First-time investors, low cash, house hacking | Experienced investors, non-occupant, quick closing |

When to Choose FHA Multifamily Financing

✅ You have limited cash for down payment (<20%)

✅ Your credit score is 580-680

✅ You’re willing to live in the property for 12 months

✅ Property is 2-4 units and meets FHA standards

✅ You want the lowest possible interest rate

✅ Purchase price is within FHA loan limits

When to Choose Conventional Multifamily Loan

✅ You have 20%+ down payment available

✅ Your credit score is 720+

✅ You don’t want to live in the property

✅ Property needs renovation or doesn’t meet FHA standards

✅ Purchase price exceeds FHA loan limits

✅ You want to avoid mortgage insurance

Pros and Cons of FHA Multifamily Financing: Is it Right for You?

Advantages of FHA Multifamily Loans

✅ Lowest Down Payment Investment Property Financing

At 3.5% down, you can purchase a $400,000 fourplex with just $14,000 down. Conventional investment loans require $60,000-$100,000 for the same property.

✅ Below-Market Interest Rates

FHA multifamily financing typically offers interest rates 0.25-0.50% lower than conventional investment loans, saving thousands annually.

✅ Easier Credit Qualification

580 credit score minimum (vs. 680-700 conventional) opens doors for borrowers rebuilding credit or new to investing.

✅ Rental Income Reduces Qualification Burden

Lenders count 75% of projected rents toward your income, making it easier to qualify for larger properties.

✅ Seller Concessions Cut Out-of-Pocket Costs

Up to 6% seller contribution toward closing costs can reduce your cash-to-close by $10,000-$24,000.

✅ Build Wealth While Living for Free (or Cheap)

Rental income from other units often covers your entire mortgage, letting you live rent-free while building equity.

✅ Path to Larger Investments

After 12 months, you can keep the property as a rental and buy another FHA property, or refinance to pull equity for larger deals.

Disadvantages of FHA Multifamily Financing

❌ Mortgage Insurance Adds Cost

- Upfront MIP: 1.75% of loan amount (can be financed)

- Annual MIP: 0.55-0.80% of loan amount (divided into monthly payments)

- On $400K loan: ~$7,000 upfront + $183-$267/month

❌ Owner-Occupancy Requirement Limits Flexibility

You must live in one unit for 12 months. This doesn’t work for pure investors wanting to remain landlords from day one.

❌ Property Must Meet Strict FHA Standards

Fixer-uppers or properties with deferred maintenance may not qualify. FHA appraisers flag issues that must be repaired before closing.

❌ County Loan Limits Restrict Purchase Price

High-cost areas may have FHA limits below median property prices, forcing you to use conventional financing or choose different markets.

❌ One FHA Loan at a Time

You can’t use FHA multifamily financing to build a portfolio quickly. After buying one property, you must wait to sell or refinance before getting another FHA loan.

❌ More Paperwork and Documentation

FHA underwriting requires extensive documentation. Expect requests for explanations, additional statements, and verification letters.

2026 FHA Loan Limits for Multifamily Properties: County-by-County Guide

FHA multifamily loan limits vary significantly by county and unit count. These limits are updated annually based on median home prices.

2026 FHA Multifamily Financing Limits (High-Cost Areas)

| Units | Low-Cost County | Standard Limit | High-Cost Area Example |

|---|---|---|---|

| 2 units | $498,257 | $598,257 | $1,149,825 (San Francisco) |

| 3 units | $602,024 | $723,024 | $1,389,275 (Los Angeles) |

| 4 units | $748,255 | $898,255 | $1,726,525 (New York) |

Find your county’s exact limits: Visit HUD.gov FHA Loan Limits and enter your zip code.

How FHA Loan Limits Affect Your Purchase

Example: Los Angeles County, CA (2026)

- 4-unit FHA limit: $1,389,275

- Median fourplex price: $1,200,000 ✅ Within limit

- With 3.5% down: ~$42,000 down payment

Example: Cook County, IL (Chicago)

- 4-unit FHA limit: $723,024

- Median fourplex price: $650,000 ✅ Within limit

- With 3.5% down: ~$22,750 down payment

Example: Rural County, Midwest

- 4-unit FHA limit: $498,257

- Median fourplex price: $350,000 ✅ Well within limit

- With 3.5% down: ~$12,250 down payment

Strategy tip: If your target market exceeds FHA limits, consider:

- Nearby counties with lower prices

- 2-3 unit properties (lower limits)

- Conventional financing with higher down payment

- Partnership to combine down payment resources

Expert Strategy: House Hacking with FHA Multifamily Financing

House hacking—living in one unit while renting others—is the single most powerful strategy for new real estate investors. When combined with FHA multifamily financing, it becomes a wealth-building machine.

Why House Hacking Works So Well in 2026

Traditional path to real estate investing:

- Save 20-25% down payment ($80,000-$100,000)

- Buy investment property

- Hope cash flow covers mortgage

- Repeat slowly as cash allows

FHA house hacking path:

- Save 3.5% down payment ($14,000-$20,000)

- Buy 2-4 unit property with FHA multifamily loan

- Live in one unit, rent the others

- Tenants cover most/all of mortgage

- Build equity while living nearly free

- After 12 months, repeat or scale up

Real-World House Hacking Example (2026)

Property: Fourplex in Jacksonville, FL

Purchase price: $420,000

Down payment (3.5%): $14,700

Loan amount: $405,300

Interest rate: 6.5%

Monthly P&I: $2,562

Taxes + Insurance: $550

Total PITI: $3,112

Rental income:

- Unit 1 (you live here): $0

- Unit 2: $1,200

- Unit 3: $1,200

- Unit 4: $1,200

- Total rent: $3,600

Monthly cash flow: $3,600 – $3,112 = +$488

Better than free: You’re getting paid $488/month to live in your own property while building equity through mortgage paydown and appreciation.

Rod Khleif’s House Hacking Framework

As I teach in my Multifamily Bootcamp, successful house hacking follows this formula:

1. Choose the Right Market

- Strong rental demand

- Low vacancy rates (<5%)

- Positive job growth

- Landlord-friendly laws

2. Underwrite Conservatively

- Vacancy: 8-10%

- Maintenance: 10% of rents

- CapEx reserves: 5% of rents

- Property management: 8-10% (even if self-managing initially)

3. Maximize Rental Income

- Rent by the room (if allowed)

- Add separate entrances

- Include utilities in rent or bill separately

- Offer furnished units at premium

- Consider short-term rentals (if allowed)

4. Minimize Living Expenses

- Choose nicest/largest unit for yourself

- Use common areas (yard, laundry, storage)

- Tenant-pay utilities when possible

- Build sweat equity through improvements

5. Exit Strategy After 12 Months Three options:

- Keep and hold: Move out, rent your unit, pure cash flow

- Refinance: Pull equity out for next deal

- Sell: 1031 exchange into larger property

FHA Multifamily Loan FAQ: Your Questions Answered

What exactly is an FHA multifamily loan in 2026?

An FHA multifamily loan is a government-insured mortgage that allows you to purchase 2-4 unit properties with as little as 3.5% down, provided you live in one unit as your primary residence for at least 12 months. These loans are insured by the Federal Housing Administration and overseen by HUD, offering lower down payments and more flexible qualification than conventional multifamily financing.

Who can qualify for FHA multifamily financing?

You can qualify for an FHA multifamily loan if you:

- Have a credit score of 580+ (some lenders require 620+)

- Meet DTI requirements (typically ≤50% including the new mortgage)

- Have 2 years steady employment

- Plan to occupy one unit as primary residence for 12+ months

- Have cash for 3.5% down + closing costs

- Purchase a 2-4 unit property meeting HUD standards

First-time homebuyers and investors with limited capital often find FHA multifamily financing the perfect entry point.

How many units can you buy with FHA multifamily financing?

FHA multifamily loans are strictly limited to 2-4 unit properties:

- 2 units = Duplex

- 3 units = Triplex

- 4 units = Fourplex

Properties with 5+ units require commercial financing (such as FHA 223(f) loans for apartment buildings, which have completely different requirements and are beyond the scope of standard FHA multifamily financing).

What’s the minimum down payment for FHA multifamily loans in 2026?

The minimum down payment is 3.5% with a credit score of 580+. Borrowers with credit scores between 500-579 may qualify with 10% down (lender discretion).

Example:

- $400,000 fourplex with 580+ credit score

- Down payment: $14,000 (3.5%)

- Loan amount: $386,000

Do FHA multifamily loans have income restrictions?

No, FHA multifamily financing has no income caps. You can earn any amount. However, your income must be:

- Sufficient to support the mortgage payment

- Verified through 2 years employment/income documentation

- Result in DTI ≤50% (including the new mortgage)

The key requirement is income stability, not income level.

Can rental income help me qualify for an FHA multifamily loan?

Yes! This is one of the biggest advantages of FHA multifamily financing. Lenders typically allow 75% of projected market rents from non-occupied units to offset your mortgage payment when calculating DTI.

Example:

- Property has 3 rentable units at $1,200 each

- Total projected rent: $3,600/month

- Allowable income offset: $2,700 (75% of $3,600)

- This $2,700 reduces your DTI significantly

What are the main benefits of FHA multifamily financing?

✅ Lowest barrier to entry: 3.5% down vs. 20-25% conventional

✅ Better interest rates: Typically 0.25-0.50% lower than conventional

✅ Easier qualification: 580 credit score vs. 680-700 conventional

✅ Rental income offsets mortgage: Live for free or even profit

✅ Seller concessions: Up to 6% toward closing costs

✅ Build equity faster: Tenants pay down your mortgage

✅ Learn property management: Hands-on experience while living on-site

What are the drawbacks of FHA multifamily loans?

❌ Mortgage insurance required: Upfront (1.75%) + monthly (0.55-0.80%)

❌ Owner-occupancy mandate: Must live in property 12 months

❌ Strict property standards: Must meet HUD safety/livability requirements

❌ County loan limits: May restrict purchase in high-cost areas

❌ One at a time: Can’t use multiple FHA loans simultaneously

❌ More documentation: Extensive underwriting requirements

How do FHA multifamily loans compare with conventional loans in 2026?

Choose FHA multifamily financing when:

- You have limited cash (<20% down)

- Credit score is 580-680

- You’re willing to live in the property

- You want lowest interest rate

- Property meets FHA standards

Choose conventional when:

- You have 20%+ down payment

- Credit score is 720+

- You don’t want to live in property

- Property needs major repairs

- Purchase price exceeds FHA limits

See our detailed comparison table above for complete breakdown.

Is FHA multifamily financing good for first-time investors?

Absolutely. FHA multifamily loans are considered the #1 entry point for new real estate investors because:

- Low capital requirement (3.5% down)

- Easier qualification than conventional

- Live-in requirement provides hands-on education

- Rental income provides immediate cash flow

- Equity building through tenant payments

- Stepping stone to larger investments

Many successful investors (including members of my Warrior Program) started with an FHA multifamily loan and house hacking strategy.

What happens after living in the property for 12 months?

After fulfilling the 12-month owner-occupancy requirement, you have several options:

Option 1: Move out and rent your unit

- Convert property to full rental income

- Cash flow typically increases significantly

- Keep property as long-term hold

Option 2: Refinance

- Pull equity out for next investment

- Potentially remove mortgage insurance (if appraised value allows)

- Finance renovations if needed

Option 3: Sell or 1031 exchange

- Use profits for larger property

- Defer capital gains through 1031 exchange

- Scale into commercial properties

Option 4: Buy another property

- Keep first as rental

- Purchase another FHA-eligible property (must be your primary residence)

- Repeat house hacking strategy

Rod Khleif’s Expert Take: Why FHA Multifamily Financing Can Transform Your Financial Future

Listen, if you’ve been dreaming of getting into multifamily real estate but thought you needed deep pockets, I’m here to tell you that an FHA multifamily loan could be the smartest move you ever make.

I’ve coached thousands of investors through my bootcamps and Warrior Program, and time and again, I’ve seen people start with just 3.5% down, buy a 2-4 unit investment property, live in one unit, and let their rental properties cover their mortgage. That’s house hacking at its finest.

But here’s what makes FHA multifamily financing even more powerful: you’re not just reducing your housing costs—you’re actually building equity while someone else pays down your mortgage. This isn’t just about buying a primary residence, it’s about creating long-term wealth with cash-flowing assets that appreciate over time.

The Real Math on FHA Multifamily Loans

Let me break down the actual numbers for you, because I believe in radical transparency. On a $400,000 fourplex:

Traditional path:

- 20% down payment: $80,000

- Total cash-to-close: ~$95,000

- Timeline to save: 4-6 years for most people

FHA multifamily financing path:

- 3.5% down payment: $14,000

- Total cash-to-close: ~$22,000 (with seller concessions)

- Timeline to save: 6-18 months for most people

That’s the difference between waiting half a decade and taking action THIS YEAR.

And if you’re worried about mortgage insurance or FHA loan restrictions, let me remind you: these are minor trade-offs compared to what you’re gaining—a low-cost entry into multifamily investing, a chance to learn the business firsthand, and an opportunity to set yourself up for bigger deals in the future.

My Personal Journey (And Why This Matters)

I started my journey in real estate with a small property, and it completely transformed my life. I’ve been through market cycles, lost everything in 2008, rebuilt from scratch, seen interest rates rise and fall, and coached investors who’ve used this very strategy to build incredible portfolios.

The investors who win aren’t the ones waiting for perfect market conditions. They’re the ones who take action with what’s available right now. And right now, in 2026, FHA multifamily financing offers the lowest-barrier entry into real estate investing we have.

My Advice to You

Don’t overthink it. If you’re serious about building wealth, take these steps:

- Talk to an FHA-approved lender this week (not next month—this week)

- Get pre-approved and know your exact buying power

- Find a qualifying property in a market with strong rental demand

- Analyze the numbers conservatively (I teach this in detail in my free resources)

- Pull the trigger when you find a solid deal

The sooner you get started, the sooner you’ll be on your way to financial freedom. And remember: this is just the beginning. The goal isn’t to live in your investment property forever. It’s to use this stepping stone to leverage into bigger deals, potentially short-term rentals, or even commercial real estate.

Your Next Steps

If you’re ready to take control of your financial future with FHA multifamily financing, here’s how I can help:

📚 Get my book: “How to Create Lifetime Cash Flow Through Multifamily Properties” – The blueprint for multifamily success

🎓 Attend my 3-Day Multifamily Bootcamp – Learn to find deals, raise capital, and scale fast

💪 Join the Warrior Program – 300,000+ units of collective knowledge and experience

📱 Follow me on Instagram – Daily insights and market updates

Let’s make 2026 the year you finally build your legacy in multifamily real estate.

Take Action Now: Your FHA Multifamily Financing Checklist

Ready to pursue FHA multifamily financing? Use this action checklist:

This Week:

- [ ] Check your credit score (all 3 bureaus)

- [ ] Calculate your DTI ratio

- [ ] Research FHA loan limits in your target county

- [ ] List 3-5 FHA-approved lenders to contact

This Month:

- [ ] Get pre-approved with chosen lender

- [ ] Identify target neighborhoods with rental demand

- [ ] Analyze 5-10 potential properties

- [ ] Visit properties and assess condition

- [ ] Run cash flow projections on top candidates

Before Closing:

- [ ] Complete home inspection

- [ ] Schedule FHA appraisal

- [ ] Negotiate repair items or credits

- [ ] Secure landlord insurance quotes

- [ ] Prepare move-in plan

- [ ] Screen potential tenants for vacant units

After Closing:

- [ ] Move in within 60 days

- [ ] Place qualified tenants

- [ ] Set up rent collection system

- [ ] Create maintenance reserve fund

- [ ] Track all expenses (tax deductions)

- [ ] Plan your exit strategy

Want a Step-by-Step Guide to Multifamily Investing?

Discover how top real estate investors build massive cash flow and financial freedom with multifamily real estate. In his book, How to Create Lifetime Cash Flow with Multifamily Real Estate Investing, Rod Khleif shares proven strategies to find deals, raise capital, and scale fast.

📘 Get Your Copy Here: Order the Book

Bottom Line: By using FHA multifamily financing to buy 2-4 unit properties with just 3.5% down, you can start building a strong real estate portfolio with minimal upfront investment and steady rental income. The 12-month owner-occupancy requirement isn’t a limitation—it’s your hands-on education and cash flow opportunity rolled into one.

Start your journey today. Your future self will thank you.

Disclaimer: This article was written with the help of AI and reviewed by Rod’s team. FHA loan requirements, limits, and terms are subject to change. Always consult with a licensed FHA-approved lender and real estate professionals before making investment decisions. This content is for educational purposes only and does not constitute financial advice.