|

CBRE recently published a report on housing affordability (buy vs rent), and they confirmed that it is considerably more expensive to buy than rent. They went on to say that this cost advantage is here to stay, and we agree! The NY Post reported that it was cheaper to rent vs buy by 60% on average across the top 50 metros in the US. In Austin, Texas, for instance, the average cost to own is $3,695 per month versus only $1,530 to rent. Multi-family is a necessity that is here to stay, but buyers need to utilize conservative rent growth projections during underwriting to account for lower income growth levels. We believe that demand for multi-family will continue to grow as 82% of renters surveyed said that home prices are out of reach for them. Payroll.org reported that 78% of Americans live paycheck to paycheck with very little savings. To buy a home, you need to have a down payment and cash reserves. |

|

|

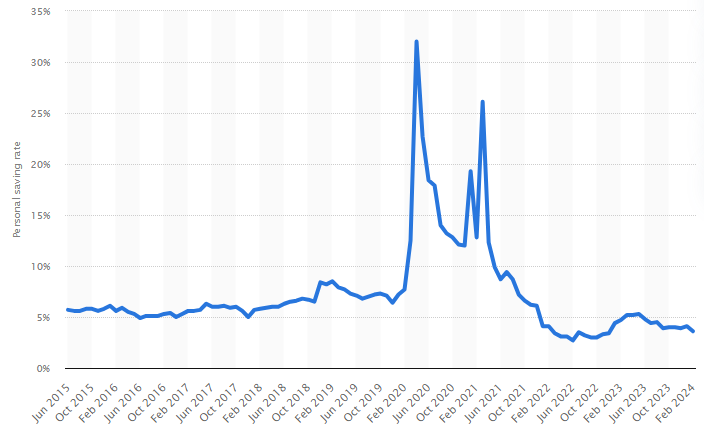

This chart illustrates the cash infusion that drove prices higher, and now, the effect on savings from higher inflation. A pre-pandemic savings rate of around 7.5% is now 4.25% and drifting lower. With the average down payment for a home in the US reaching $35k, it is simply out of reach for most Americans. On top of the price of homes, inflation is making it more expensive to build new homes, insurance costs have skyrocketed, and mortgage rates at 7% are pretty much near the long-term average. The 30-year mortgage averaged 8.5% from 1970 to 2000, and 5.0% from 2000 to 2020. It is hard to see interest rates drifting back to the 5% level, never mind to 3%. People need an affordable place to live, and that is why we like multi-family investing. From a supply perspective, the amount of new multi-family construction over the past couple of years has pressured net absorption for rental units, resulting in the average US vacancy rate edging from 6% in 2022 to 6.6% in 2023. We still see another year and a half of material construction completions, then it is projected to drop off significantly. The impact of new construction needs to be evaluated at the sub-market level because some areas in the US are having no negative impact from new supply. For instance, in San Antonio, where we own two assets, MMG is forecasting demand will far outstrip new supply for 2025 and 2026. Multi-family is not without challenges, but the future continues to be very bright. When evaluating deals, look to make sure the financing is conservative, the rent growth projections are reasonable, and inflation is factored into the expenses. Many of the current challenges facing multi-family deals are not market-based but borne from risky financing, overly optimistic assumptions and overpaying for the asset. |