|

Arbor Realty (stock symbol ABR) is a public company that is focused on lending to multi-family development and value add projects. As a public company, they are required to report their results and give investors some insight as to what is going on behind the scenes. They recently reported results that highlighted a startling increase in loan delinquencies. |

|

|

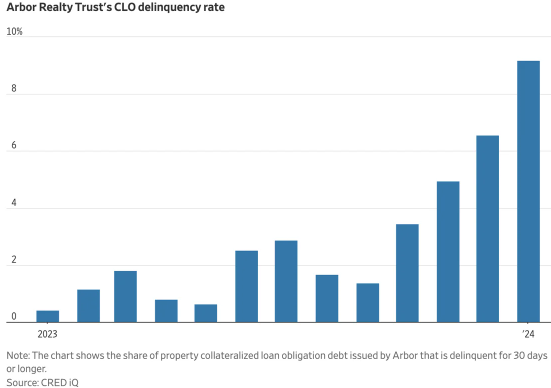

Background: Arbor Realty is one of the largest lenders of floating rate debt loans to multi-family investors. Unlike Agency debt that required investors to put up 30-40% equity in a deal, Arbor only required 20%, and they were known to lend to syndicators with very little experience. Many of the borrowers were multi-family turn-around projects where the plan was to fix up the property and resell before the rate cap expired. A three-year rate cap on a $100m loan in 2021 cost $51k. Today, the same rate cap costs $5.4M; anyone that was unable to execute their plan within 3 years could be in serious trouble. The Wall Street Journal reported that of the 4,500 rate caps sold in 2021, 65% have expired and 30% will expire by the end of 2024. One of Arbor’s borrowers was Jay Gajavelli, who somehow managed to acquire loans to purchase over 7,000 units in the Houston area with very little real estate experience. Gajavelli went belly up last year, and Arbor ended up having to sell the properties in foreclosure. “We are in a period of peak stress and expect the next two quarters to be challenging.” – Arbor CEO Ivan Kaufman In Q4 2023, Arbor reported a net increase of $115M in delinquency and increased loan loss reserves from $132M to $196M. Arbor’s CFO noted that if rates remain elevated, the problem will persist through 2024. Many analysts think that Arbor is glossing over the problem. Banco Santander said that Arbor had over 16% of loans past due. Viceroy Research pointed out that in 2021, Arbor listed 61% of loans had a “pass” rating (which means no credit concerns) versus only 1.7% in Q4 2024. Arbor now lists over half of their loans as “special mention”, which means they are a potential credit problem. The longer rates remain elevated, the more multi-family properties with floating rate debt will slip into trouble.

Where are rates heading? FED Chairman Jerome Powell announced on March 20th that rates would remain unchanged for now. However, the FED still is maintaining that there will be 3 rate cuts in 2024, which would bring the rate down to 4.6%. Powell also said that “Strong hiring in and of itself would not be a reason to hold off on rate cuts.” It really comes down to inflation. If inflation persists, then rate cuts could be in jeopardy.

Opportunity: We expect more and more distressed multi-family properties to come to market in 2024 due to over leverage, higher interest costs and lack of revenue growth. Many investors will be forced to sell as they simply run out of cash. We should be able to find very attractive assets with solid returns utilizing very conservative fixed debt financing and moderate rental income growth assumptions. This is a game of patience. As Warren Buffet says, “Be fearful when others are greedy, and be greedy when others are fearful.” |