A letter of intent in real estate (LOI) is a critical document used to outline key terms in business transactions before drafting a formal contract. This guide will walk you through its purpose, structure, and legal implications.

What is a Letter of Intent in Real Estate?

A LOI in real estate is a letter that states your intent to purchase property and serves as a non-binding or binding preliminary agreement between buyers and sellers. It establishes the framework for the proposed transaction, including the purchase price, lease terms, closing dates, and due diligence period before signing a legally enforceable contract.

While typically non-binding, some provisions, such as confidentiality, exclusivity, and dispute resolution clauses, may be legally binding and enforceable. Understanding these distinctions is crucial when structuring a letter of intent real estate sale.

Why Use a Letter of Intent?

When making an offer on a property, there are two primary approaches:

-

Purchase and Sale Agreement (PSA)

- A detailed, legally binding contract requiring legal assistance.

- More costly and time consuming than an LOI.

-

Letter of Intent

- A streamlined, low cost way to negotiate in good faith before drafting a formal agreement.

- Helps both parties clarify terms and reduce legal costs before committing.

An LOI can simplify negotiations and set clear expectations, ensuring a smoother transaction process.

How to Write a Letter of Intent

Best Practices:

- Keep it straightforward and concise

- Use industry standard term sheets for a professional structure

- Specify whether the LOI is binding or non-binding

A commercial real estate LOI can help investors negotiate in good faith while ensuring all critical details are covered.

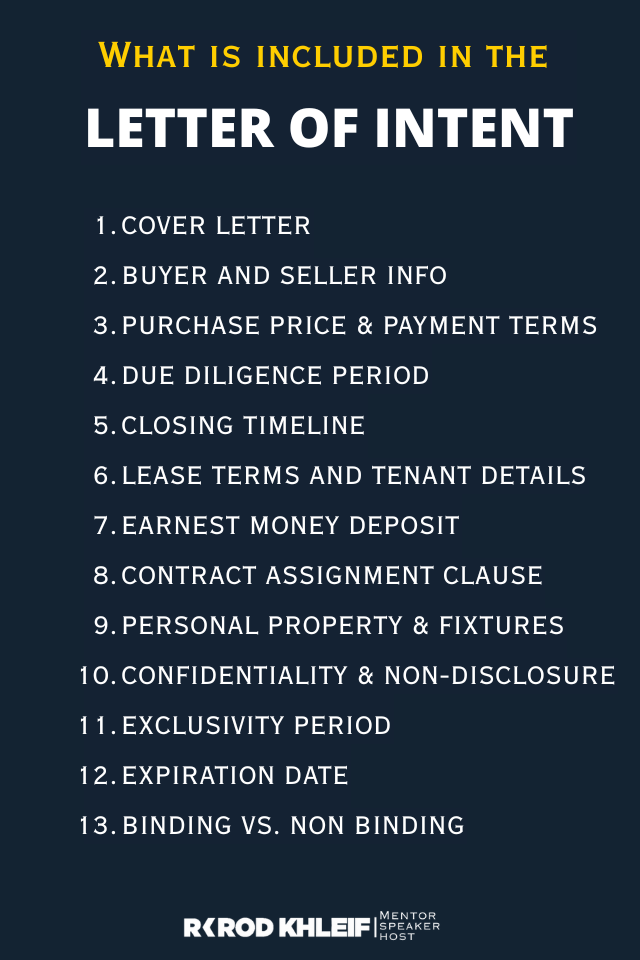

What Should Be Included in a Letter of Intent (LOI)?

A clear, concise letter of intent lays the groundwork for a smooth transaction. At minimum, it should cover:

Cover Letter

A well written LOI should include a professional cover letter, introducing the buyer and summarizing their intent to purchase.

Buyer and Seller Information

- Full legal names of each party (individual or entity)

- Entity type if applicable (LLC, trust, partnership)

- Mailing addresses, phone numbers and email contacts

- Identification of legal representatives

Purchase Price and Payment Terms

- Total proposed purchase price

- Cash versus financing breakdown

- Financing contingency (yes or no)

- Earnest money and how it applies toward the final price

- Any creative terms (seller financing, debt assumption, 1031 exchange)

Due Diligence Period

- Start date and duration (commonly 15 to 45 days)

- Access rights to leases, financials, inspection reports and surveys

- Right to terminate based on due diligence findings

Closing Timeline

- Time from LOI acceptance to executed purchase agreement (eg five to ten business days)

- Time from executed agreement to closing (eg thirty to sixty days)

- Conditions for extensions and which party pays

Lease Terms and Tenant Details (If Applicable)

- Overview of existing lease obligations

- Delivery of rent rolls, estoppel certificates and payment history

- Whether leases assign to the buyer or terminate at closing

Earnest Money Deposit

- Amount (often one to three percent of purchase price)

- Escrow holder and account details

- Refund conditions and triggers for non refundability

Contract Assignment Clause

- Permission to assign LOI or purchase agreement to affiliates or syndication entities

- Any required approvals for assignment

- Restrictions on flipping without consent

Personal Property and Fixtures

- List of included appliances, HVAC equipment, signage or furnishings

- Clarify what stays and what goes at closing

Confidentiality and Non Disclosure

- Prohibit sharing deal terms with third parties or media

- Carve outs for advisors and lenders

Exclusivity Period

- Timeframe during which the seller may not solicit other offers (eg fourteen to thirty days)

- First right of refusal options if off market marketing continues

Expiration Date

- Deadline for LOI acceptance

- Statement that terms void after expiration unless extended

Binding versus Non Binding Provisions

- Clearly mark which sections carry legal force (commonly confidentiality, exclusivity and assignment)

- State that price and intent to buy are non binding pending a formal purchase and sale agreement

Including these elements ensures both sides share the same roadmap before drafting a detailed contract.

Is an LOI Binding?

A binding letter of intent is rare, but certain clauses can be legally enforceable. To avoid confusion, clearly say if the LOI is binding or non-binding. Also, mention that a purchase and sale agreement will come after both parties agree on the final terms.

When Do You Use an LOI in Real Estate?

An LOI is ideal for:

-

Commercial multifamily acquisitions or dispositions

-

Syndication deals and investor syndicate formations

-

Merger and acquisition scenarios involving real estate assets

-

Lease term outlines for multifamily properties

By clarifying key terms early, buyers and sellers save time and legal fees while mitigating misunderstandings.

Why Should You Always Use an LOI?

Using a LOI in a real estate sale provides multiple benefits:

- Saves time by aligning expectations before drafting a full contract.

- Minimizes legal expenses by reducing unnecessary contract revisions.

- Protects buyers by securing a due diligence period before finalizing the deal.

A letter of intent in real estate serves as a valuable tool for buyers and sellers, ensuring transparent negotiations and structured agreements.

Download a Free Sample LOI

Download a Free Sample LOI

If you need a real estate letter of intent sample, I’ve got you covered. Download my free LOI template to structure your deals the right way.

👉 Get Your Free LOI Sample Here

Learn More About Multifamily Investing

If you’re looking for a real estate letter of intent sample or guidance on drafting a binding letter of intent real estate, check out my book on Multifamily Real Estate Investing.

📘 Download my free book: How to Create Lifetime Cashflow Through Multifamily Properties

🎧 Listen to my podcast: Lifetime Cashflow Through Real Estate Investing

Disclaimer: This article was created with the assistance of AI and reviewed by Rod Khleif to ensure accuracy and relevance.