Columbus Housing Market: Key Stats & Trends

Columbus is making national headlines with major economic development projects, most notably Intel’s $20 billion chip plant in New Albany, which is expected to create:

- 3,000 new manufacturing jobs

- 7,000 construction jobs

Additional large-scale developments in Central Ohio include:

- The Ohio State Wexner Medical Center: $1.9B, 820-room hospital (opening 2026).

- Grant Medical Center: $400M, 270,000 sq. ft. expansion.

- OhioHealth Dublin Methodist Hospital: $200M expansion.

- Ease Logistics HQ: Bringing in 700 employees.

In 2023, Columbus added 14,000 new jobs (a 1.2% increase, the highest in Ohio), reinforcing a strong labor marketand sustained demand for housing.

Population Growth & Housing Affordability in Columbus

Our sub market analysis of Columbus shows that is the 14th largest city in the U.S., with a population of 900,000. However, growth has slowed since 2020, with a 0.5% increase in 2023, driven mainly by international immigration.

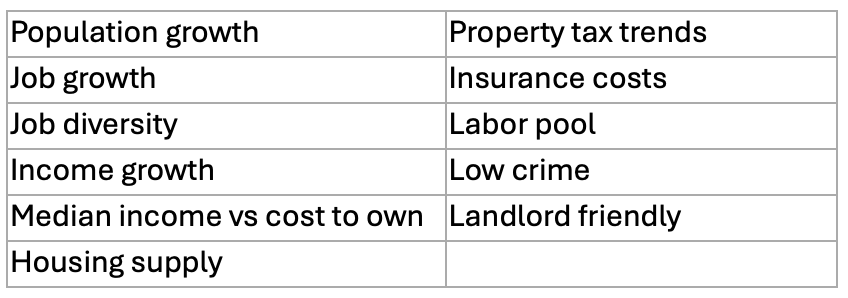

Key housing market trends:

- Median home prices: $290,000.

- Median household income: $63,000.

- Average rent: $1,300/month (1.5% YoY growth).

- Rent-to-income ratio: A resident needs $52,000 annually to afford a typical apartment.

- Home affordability gap: Buyers need $100,000 in annual income to afford the median home ($2,500/month mortgage), well above median earnings.

- 56% of Columbus residents rent, reinforcing demand for multifamily properties.

While rental affordability remains strong, home prices have pushed more people toward renting, further fueling demand in the Columbus housing market.

Employment Diversity & Market Stability

One of Columbus’ strengths is its diverse job market, which provides stability for property owners and investors:

- Healthcare: 16%

- Retail: 14%

- Manufacturing: 10%

- Financial Services: 10%

- Transportation & Logistics: 9%

- IT & Professional Services: 12%

- Government & Education: 7%

With job growth expected to continue, wages should rise, supporting further rent growth and demand for multifamily properties in the Columbus area.

Multifamily Market Trends & New Construction

Columbus has been a top-performing multifamily market, with Marcus & Millichap ranking it among the top tertiary markets for apartment transactions.

New Apartment Construction & Vacancy Trends

- Ranks 3rd in the Midwest for new apartment construction (2023).

- 1,500 new units delivered per quarter over the past year.

- 9,000 additional apartments currently under construction.

But here’s the challenge:

- Columbus added 4,500 residents in 2023, but built 6,000 apartments, outpacing demand.

- As a result, vacancy rates have increased to 5.7%, up 80 basis points YoY.

- With more supply in the pipeline, some submarkets may experience rising vacancies.

If demand doesn’t keep pace, rental growth could slow in certain areas, making it essential for investors to be selective in their property type and location.

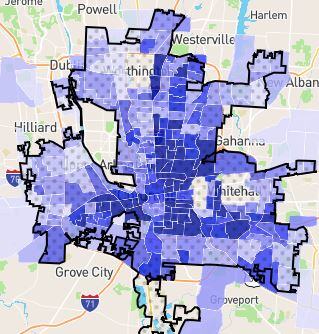

Crime & Safety in Columbus

One of the biggest concerns when investing in the Columbus real estate market is crime. Statistically, Columbus is one of the most dangerous cities in the U.S.:

- Ranks 5/100 for safety (95% of cities are safer).

- 40 out of every 1,000 residents are victims of a violent or property crime.

- Columbus has one of the highest car theft rates in the country.

For investors, this means carefully evaluating submarkets before purchasing. A deal can look strong financially, but location matters when it comes to occupancy, tenant retention, and rent growth.

Upcoming Zoning Changes & Investment Risk

A major factor that could impact the Columbus housing market is a proposed zoning change currently under review by the Columbus City Council.

Key Changes in the Proposal:

✔ Loosens density restrictions, increasing the number of buildable units.

✔ Expands the development potential from 12,000 to 88,000 new housing units.

✔ Streamlines approval processes, making it easier for developers to build.

Why This Matters for Investors:

- Some submarkets could see a flood of new supply, impacting rents.

- Previously stable neighborhoods may experience increased density.

- Faster construction approvals could shift long-term demand-supply balance.

Investors need to understand which areas are affected and how these zoning changes could reshape the Columbus housing market.

Our Thoughts: Investing in Columbus

We like Columbus, but not all of Columbus. Here’s our assessment:

✔ Strong job growth supports rental demand.

✔ Favorable taxes & insurance costs make it attractive for investors.

✔ Rent is still affordable, and home prices remain out of reach for many buyers.

⚠ Crime is a major issue, so neighborhood selection is critical.

⚠ New apartment supply is increasing, which could impact vacancies.

⚠ Potential zoning changes could shift the market in unexpected ways.

When evaluating a deal in Columbus, we focus on employment trends, local crime rates, new construction risk, and upcoming zoning changes before moving forward.

Is Columbus Still a Good Market for Investors?

Columbus remains a strong market for multifamily investment opportunities, but careful due diligence is key. Real estate investors should stay on top of market trends, monitor home prices, and assess submarket conditions to make informed decisions.

Columbus remains a solid market for multifamily investment, but like any city, it requires careful evaluation. With strong job growth, a diverse economy, and steady rental demand, there are plenty of opportunities—but rising supply, crime concerns, and potential zoning changes mean investors need to be strategic about where and what they buy.

If you’re looking for expert guidance on navigating the Columbus real estate market or multifamily investing in general, Rod Khleif has been helping investors find and close great deals for years. His expertise in market analysis and deal structuring can help you make smart, data-driven investment decisions. Reach out to learn more.