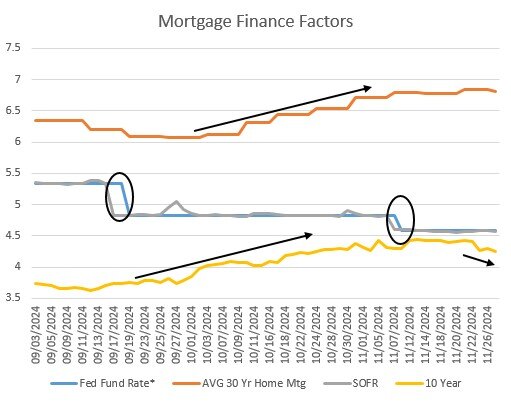

When the FED alluded to potential rate cuts starting mid-year, the real estate industry was elated with the prospect of lower rates. The FED followed through with two rate cuts (highlighted with circles on the chart below), first in mid-September, then again in mid-November. Despite the early optimism, mortgage rates have not fallen, which has left many scratching their heads.

Before we try to answer that question, let’s first look at how mortgage rates are determined. The FED Funds Rate is the interest rate that banks charge each other to borrow money overnight. Mortgage rates are not tied to the FED Funds Rate, but changes in the rate can influence mortgage rates indirectly. In general, fixed rate mortgages are based on the 10-year Treasury plus a risk spread. For lenders, the risk spread is higher when they are worried about the economy and lower when they feel like the economy will perform well. Variable rate commercial mortgage rates are tied to SOFR (Secured Overnight Financing Rate) plus a risk spread. Historically, when viewed on a long-term basis, the 10-year and SOFR are fairly correlated (0.86), so changes in the FED Funds Rate will impact floating commercial mortgages more than 30-year home mortgages.

In the chart you will notice that the 10-year Treasury note (yellow line at the bottom) has trended higher despite the FED rate cuts. The reason for this is that the 10-year is a barometer for what the market anticipates for the future. When the economy shows strength, investors are less likely to be interested in Treasuries, so to attract buyers, rates need to rise. Over the past few months, economic data was mixed but in general the economy has been showing signs of strength. Strong job and productivity data and higher inflation expectations have led some to believe that the FED may pause future rate cuts. In the November FED minutes, the committee said that future interest rate cuts were likely but to expect them to come gradually. Some economists even now think we will not see any more rate cuts in 2025.

Freddie Mac is currently offering fixed 10-year mortgages for multi-family properties in the range of 5.6% to 5.9% based on the 10-year of 4.25% plus a spread of 135bps to 165bps depending on a number of factors, including loan to value for the deal. If you look at the chart, you can see that the 10-year has drifted lower recently, and that is good news for multi-family investors. For the average homeowner, rates have continued to rise despite rate cuts and have recently leveled off just below 7%.

The message for buyers is, do not expect any extreme mortgage rate changes over the next few years unless we see the economy collapse or overheat. To keep things in perspective, over the past 50 years, the average 30-year mortgage rate has been 7.75%. We most likely are in a period where mortgage rates for commercial multi-family and single-family homes will move between 5%-7%, so buyers need to plan accordingly.