The Personal Financial Statement in Real Estate: A Tool for Financial Planning and Investment Success

In multifamily real estate, the numbers define your trajectory. Whether you’re trying to close your first 12-unit deal or scaling into 100+ unit acquisitions, your financial credibility is crucial. One of the most overlooked yet powerful tools in your investing toolbox is the personal financial statement.

This document communicates your financial health, discipline, and ability to close deals. In many ways, it’s your financial handshake before you even enter the room.

This guide breaks down everything you need to know about creating, understanding, and using a personal financial statement for individuals to secure financing, strengthen relationships, and grow your portfolio with confidence.

What Is a Personal Financial Statement?

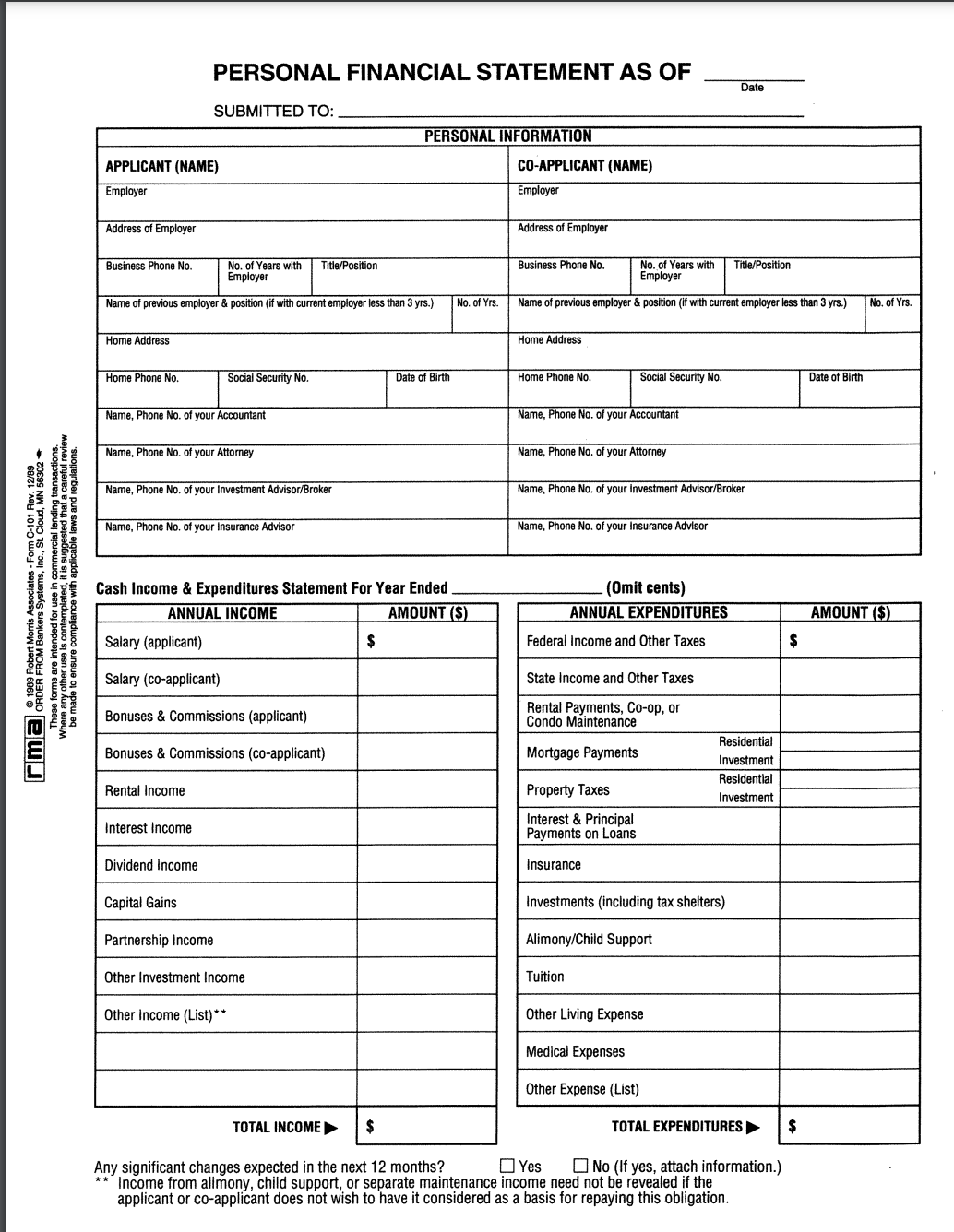

A personal financial statement is a snapshot of your financial position at a specific point in time. It outlines what you own (assets), what you owe (liabilities), and your income and expenses. In essence, it functions as both your personal balance sheet and income statement.

But in real estate, your PFS becomes your most important tool for:

- Securing financing

- Building trust with brokers and sellers

- Tracking your net worth over time

- Making strategic decisions aligned with your financial goals

Lenders use the financial statements of individuals to assess liquidity, solvency, and the capacity to weather downturns. Think of your PFS as your financial resume; the more detailed and honest it is, the more “bankable” you become.

Need a blank financial statement? CLICK HERE for a sample personal financial statement template.

Why Does The Personal Financial Statement Matter in Real Estate?

Multifamily real estate is high stakes and relationship driven. The financing is complex, and your reputation as an investor matters. Here’s why a well-prepared PFS is essential to success:

1. It Builds Trust With Lenders

Commercial lenders don’t lend based on emotion, they lend based on your financial situation. Your PFS helps answer:

- Do you have the capacity to support the loan?

- Do you have the savings accounts or liquid assets to cover unexpected costs?

For large multifamily loans, lenders often require:

- Net worth equal to or greater than the loan amount

- Post-closing liquidity equal to 10% of the loan amount

Your assets included in the PFS should demonstrate both net worth and liquidity.

2. It Builds Credibility With Brokers and Sellers

When you include a clear, professional PFS with your LOI (Letter of Intent), you:

- Establish yourself as a serious buyer

- Strengthen your offer in a competitive market

- Position yourself for off market deals

3. It Improves Your Financial Planning

Even if you’re not buying today, your PFS helps track:

- Net worth growth

- Income-to-expense ratios

- Asset allocation

- Your readiness for the next deal

It provides visibility into your personal finances and lets you invest from a position of clarity and strength.

4. It Prepares You for Bigger Partnerships

As you scale, you may partner with others to pool capital. Your PFS:

- Shows your value to the partnership

- Helps secure financing as a group

- Builds trust in your financial discipline

How Lenders Use Your Personal Financial Statement

When applying for financing, your personal financial statement gets underwritten just like the property does. Lenders assess:

- Net worth vs. loan size

- Liquidity post-closing

- Debt obligations and contingent liabilities

Recourse vs. Non-Recourse Loans

- Recourse loans require a personal guarantee; your personal assets are on the line

- Non-recourse loans don’t require a guarantee, but lenders still assess your financial health

Core Components of a Strong Personal Financial Statement

A. Sponsor Information

Includes your name, contact info, employer, position, and investing affiliations.

B. Assets

Liquid assets include:

- Checking and savings accounts

- Stocks and mutual funds

- Cash value life insurance

Long-term assets include:

- Real estate holdings

- Retirement accounts

- Notes receivable

- Private business interests

C. Liabilities

Outline all debts, including:

- Mortgages

- Credit cards

- Auto and business loans

- Student loans

- Personal guarantees

D. Net Worth

Net Worth = Total Assets – Total Liabilities

Your net worth should be equal to or greater than the loan amount you’re applying for.

E. Contingent Liabilities

These include any obligations where you’ve guaranteed debt for others. Lenders want to ensure you’re not overexposed.

F. Personal Income Statement

Shows income vs. expenses to help lenders evaluate cash flow and repayment ability.

G. Financial Disclosures

Include anything that could affect your risk profile:

- Tax liens

- Legal actions

- Bankruptcy

- Divorce settlements

A Financial Planning Tool for Every Investor

Your personal financial statement isn’t just for lenders. It helps you:

- Monitor financial health

- Identify areas for improvement

- Align actions with financial goals

- Maintain control of your financial situation

Pro Tip: Update your PFS annually or before any major deal.

Final Thoughts From Rod Khleif

Your personal financial statement is more than a document: it’s a strategic asset. It helps you understand your financial position, present yourself as a capable investor, and plan your path toward financial freedom.

I’ve seen countless investors accelerate their success simply by gaining clarity over their numbers. A clean, updated PFS builds confidence, reduces friction in deals, and strengthens your investing foundation.

If you’re serious about taking your investing and financial planning to the next level, join me at my next Multifamily Bootcamp or grab your free copy of How to Create Lifetime Cash Flow Through Multifamily Properties. Let’s build something great together.

The #1 Multifamily Investing Event!

Ready to Build Your Multifamily Empire? 🚀