Warrior Win

Greg

Chew

I have been a Warrior since January 2019 after attending the Tampa boot camp. I had no prior real estate experience before that. I love having new travel experiences with my family, and I hope to do a lot more of that when I retire from my IT career — hopefully this coming year!

Property Details

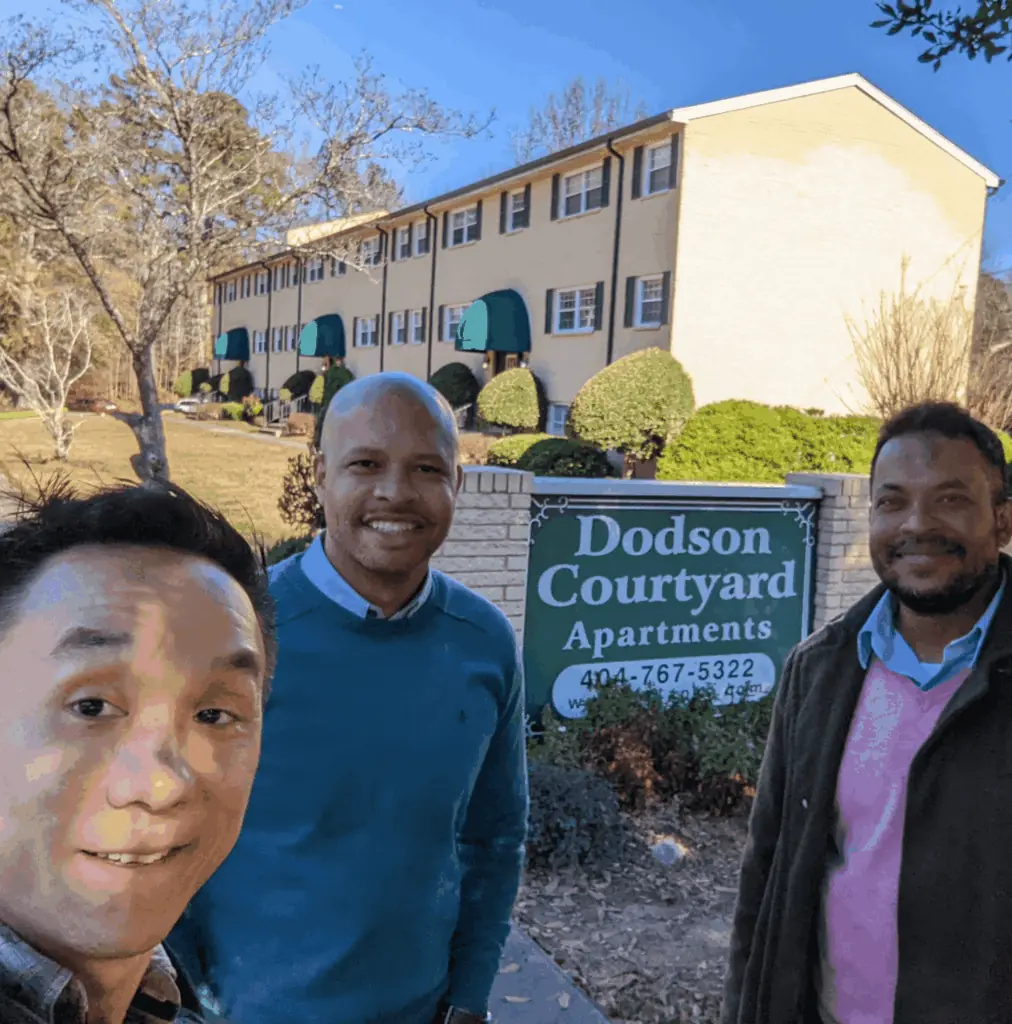

Address: Bullock Habersham and Dodson Courtyard (Two-asset portfolio)

Number of Units: 203

Value Add Deal? Yes

Purchase Price: $20,455,000

Estimated monthly increase projected? $127/unit

Anticipated value after value add: $27,797,231

Estimated Cash on Cash Return: 9.84%

Estimated Internal Rate of Return: 16.4%

Warrior team

shout outs:

Any comments about your experience so far in the Warrior Program?

I love the amount of networking and the education that the Warrior program brings. In addition, everyone in the group is so helpful and willing to guide other Warriors along the way. It’s also great to find terrific partnerships within the program.

How did you find this property?

Through an existing relationship with the lead sponsor of a deal that I was an LP in. He invited myself and my business partner on the GP team to help out with the asset management and capex upgrades, as well as capital raising efforts.

How did you structure the financing of this property?

Freddie Mac, Variable rate, 10-year ARM. 76% LTV, with I/O of 5 years, Interest rate of 2.95%.

Was this a joint venture or syndication?

Syndication

How did you raise the equity?

Communications to Investor base, Webinar, friends, family, colleagues.

What was the equity raise?

$7,750,000

What are some hurdles you had to overcome to get this deal done?

This was my first capital raise, so it was quite nerve racking to get to the finish line. There were quite a few of my investors that soft committed but then never followed through with me.

What are some of the lessons you learned with this deal?

An investor is not committed until the docs are signed and the wire is transferred through! And also spend lots of time following up and keeping in front of my investor base throughout the entire process, ensuring that they are fully reprised of the investment, and make sure that I spend the time to and energy to answer any questions that they may have in a very timely manner.

* These examples depicting income or earnings are NOT to be interpreted as common, typical, expected, or normal for an average student. Although we have numerous documented successful deals from our coaching students, we cannot track all of our students’ results, and therefore cannot provide a typical result. You should assume that the average person makes little to no money or could lose money as there is work and risk associated with investing in real estate. The students depicted have participated in Rod’s training and coaching. The participants shown are not paid for their stories.